Why Everyone Missed the Most Important Invention in the Last 500 Years

You’ve never heard of Yuji Ijiri. But back in 1989 he created something incredible.

You’ve never heard of Yuji Ijiri. But back in 1989 he created something incredible.

It’s more revolutionary than the cotton gin, the steam engine, the PC and the smart phone combined.

When people look back hundreds of years from now, only the printing press and the Internet will have it beat for sheer mind-boggling impact on society. Both the net and the printing press enabled the democratization of information and single-handedly uplifted the collective knowledge of people all over the world.

So what am I talking about? What did Ijiri create that’s so amazing?

Triple-entry accounting.

Uh, what?

Yeah. I’m serious.

But don’t feel bad if you slept through the revolution. It wasn’t televised or posted on Reddit. When Professor Ijiri died in 2017, most people didn’t catch his obituary. His most famous book, Momentum Accounting & Triple-Entry Bookkeeping, has a grand total of zero reviews on Good Reads. So you’re not alone if you missed it.

Go ahead and Google “triple-entry accounting” and see what comes up.

232,000 results. In the age of Google that’s like not existing. Minor Instagram celebrities and memes invented last week have more hits.

The number two link is a Wikipedia article that’s barely a stub. The fourth down is a paper from 2005. Ijiri isn’t even mentioned on the first page.

So why is it so important if nobody knows about it?

Because the first application for it didn’t come along until 2008 and so it’s real impact is still to come. But make no mistake, it’s coming like a tsunami that will remake every aspect of our lives and societies.

How do I know?

To understand why, you just need to know a little about history’s sexiest subject.

Accounting: History’s Sexiest Subject

Here’s the thing: Without accounting, you wouldn’t be reading this article on your iPad, or driving to work in a new car or listening to music on Pandora. Without accounting there’s no commerce, no trade. Without commerce there would be no planes, no trains, no tractors, no steam engine, no skyscrapers or computers. There would be no nation states, no boats, no shipping containers traveling all over the world ferrying goods from the far corners of the Earth.

In fact, without accounting you’d still be subsistence farming or hunting in the forest.

You see, there’s only been two accounting breakthroughs in the entire history of the world before now.

Both of them presaged a massive uptick in human societal complexity and innovation.

The first breakthrough was single-entry accounting.

Before that we were running around the forest chasing animals, following the moon or farming. Our prospects were limited. You lived with your tribe or clan and you hunted and gathered. Your parents before you did the same thing and theirs before them and theirs before them in an endless cycle down through the years.

Accounting broke that cycle.

For the first time we had the ability to bootstrap ourselves into a different kind of life, one that didn’t involve every single person on the planet living hand to mouth.

The earliest examples of single entry accounting go back to the Sumerians about 5000 years ago on cuneiform tablets. Yeah, those Sumerians, the ones who gave us the Epic of Gilgamesh, the world’s oldest recorded story. These systems were simple but effective. You just put one note in a ledger. So-and-so owes me $50.

Once you can keep track of who owns what, trading starts to happen at a much larger scale. That’s why the kings and queens of ancient times could build castles and establish professional armies and create great wonders of the world.

But single-entry accounting isn’t very good. It can only take you so far. The only accountants back then were the king’s brother because you really had to trust that guy. All he had to do was wipe away a line in the ledger and that money no longer existed. There was no way to verify, no way to audit, no way for two people to agree.

That meant trade was a family affair. The kings and queens traded with the dukes and mostly they kept all the money for themselves and left the rest of us to starve. Powerful clans dominated the Earth.

Double-Entry to the Rescue

It wasn’t until the 1400's that the single-entry system really started to show its age though. For the first time, you had boats that could travel from near and far. That meant they could trade with people they’d never met. Since boats became the most important way to carry goods to distant lands, port city-states like Venice became the center of the ancient world and the nexus of world trade. But with so much trade going on, single-entry accounting showed even more cracks. It’s easy to make data entry errors. People’s books were soon a hopeless mess of conjecture and lost money. The more trades that stacked up, the more errors.

Multiple civilizations from the Italians in the 1300's, to the ancient Koreans, to the second Muslim Caliphate all developed versions of a double-entry system. The systems never caught on though. And that brings us full circle to the most important invention in the history of man: the printing press. Without it, knowledge remained siloed. People would develop a breakthrough in one area of the world, only to die off and leave no trace. The press allowed people to make hundreds of thousands of copies and that meant knowledge survived and circulated, instead of dying with its creator.

By the 1400’s, a Franciscan friar finally codified the double-entry system and it swiftly became the standard with Venetian merchants. All thanks to the preserving power of print.

This opened up world trade. Now goods could flow easily to all the empires of the old world.

Fast forward to today and we still use a double-entry system. If you do your taxes in TurboTax or keep your books in Quickbooks you’re using double-entry.

But now those systems are starting to show their age badly.

Take a company like Enron. They did all kinds of things to cook the books. They managed to hide billions in debt.

And that’s where Triple-entry Accounting comes in.

The Dawn of Triple-Entry

Most people missed Professor Ijiri’s breakthrough because it straddles two equally obscure and poorly understood fields: cryptography and accounting.

It’s rare enough to find a person who’s versed in one of those disciplines, never mind both. Without that kind of interdisciplinary understanding, it’s no surprise that his invention went over like a lead zeppelin.

There’s also the little problem that he was incredibly ahead of his time. Encryption had not yet entered the public consciousness. If you work in information technology you might remember the Clipper chip scandal, where the NSA tried to mandate a backdoor in all encryption. That was in 1993. Ijiri published his work in 1989. It passed mostly unacknowledged by the general public.

In 2005, came a more well-known example of a triple-entry accounting system, created by famed cryptographer Ian Grigg.

Then, in 2006/2007, a self-taught programmer likely stumbled on one or both of the systems. He was working on an alternative currency, with no centralized trust.

It was called Bitcoin.

It was the first working example of triple-entry accounting.

Now I know what you’re thinking. Please not another story on how Bitcoin changed the world. But here’s the deal, whether Bitcoin survives or fails, the blockchain will continue to thrive and flourish, as will triple entry accounting. Corporations and governments that initially scoffed at it are now racing to adopt its power. (Oh and I don’t think Bitcoin will die either. It’s here to stay, like it or not haters.)

At the recent Consensus summit in New York City, I counted Deloitte and Touche, IBM, Intel, Microsoft, Deutsche Bank, US Dept of Health and Human Services, The World Bank, the Hong Kong Monetary Authority, Toyota, Fidelity and Citi among the attendees. JP Morgan announced they were incorporating the anonymity protocol of Zcash into their own enterprise blockchain, an idea which would have seemed absurd only a few years ago.

But here’s the thing: We’re only at the caveman stage of what we can do with blockchains.

We’ve been playing around with funny money, making currency and trading it, but the utility of these currencies in the real world has so far remained limited to speculators and early adopters.

But blockchains can do much, much more, as can the cryptos that drive that innovation.

One Pill Makes You Larger

Triple-entry accounting and by extension blockchains and crypto are a way of agreeing on objective reality. It’s not the objective reality. That’s a philosophical black hole we’ll ignore for now, but it’s an objective reality. It’s two parties agreeing on a version of past events. The third entry in the system, entered into the blockchain, is both a receipt and a transaction. It’s proof that something happened between two parties, which goes beyond the receipts that each party holds in double entry.

But all that is theoretical. Why does it matter? What can you do with it?

So many things.

I Won the Popular Vote

How about voting?

We have tons of problems with voting today that we’ve hedged against in advanced democracies and completely failed to deal with in banana republics, third world countries and authoritarian regimes the world over.

How many people voted?

Did they already vote?

Was their vote recorded properly?

Did their vote reflect their intention?

How can we audit it all later, easily and quickly?

Can we trust that audit?

And that’s just the tip of the iceberg.

There’s also the little problem of counting those votes accurately. Even in 2017, that’s fraught with error, subject to the the honesty of the vote counters and the checks and balances in the systems to prevent fraud. We also have proprietary voting machines that we can’t publicly audit or trust, where countless failures in the chain of custody of the machine could see the votes altered.

Blockchains can change all that by ensuring that votes are provably correct and publicly auditable.

What we’ll see in the not too distant future is the merger of what’s called E2E voting systems (end-to-end verifiable voting, and blockchain-based systems.

E2E means that everyone in the entire population, down to the individual voter, can verify the results. Every individual knows his or her vote was recorded accurately and they can check it themselves. They don’t have to trust someone to tell them it was correct like we do today. They can also see that everyone else cast their vote with certainty. But despite this amazing transparency, it still preserves the all-important secrecy of ballots, which prevents coercion and group-think.

Today we can’t do any of that (other than keep ballots secret). We can generally attest to the integrity of elections but we can’t prove it, which is why a certain person who won an election recently sometimes claims he won the popular vote by two million. E2E changes that. Politicians may not like it, because they have a stake in being able to say the votes are rigged, but too bad for them, because the rest of us want absolute voting integrity.

There are multiple examples of E2E systems in use today, such as Helios developed by Ben Adida of Harvard’s Center for Research on Computation and Society. It’s not ready for the high stakes of a national election yet but it’s been used on the small scale for campus wide votes. Think of these as alpha tests.

What about voting on the Internet? That’s where the blockchain comes in. If you can marry an E2E voting system with the efforts behind decentralized identity and reputation systems, you can deliver E2E distributed voting too, aka “Internet voting.” That’s one of the goals of the Cicada project and other decentralized platforms like the recently formed decentralized Digital Identity consortium.

Bye, Bye Enron

What else can you do with triple-entry accounting?

One of the simplest and most promising use cases is for issuing stock.

Let’s say you have a little company that we’ll call Enron. It’s doing tremendously well. You’ve got a million shares of stock, say 10% of the total shares.

At least you think you do. You’ve got an official looking piece of paper that says you own a million shares. That’s legit, right? It has a stamp and everything.

Except you don’t really, because they were cooking the books or issuing double shares. With today’s double entry systems it’s a security problem to give you access to their books. They live behind the corporate firewall.

But triple-entry changes all that. We can issue stock and you can check your stock against the blockchain. Now you don’t need access to their books to verify that you actually have 10%. You can look at the chain, see that there were 10 million shares issued and that you have a million, so you have 10% for realz.

That might not stop them from completely cooking the books, but it goes a long way towards stopping lots of financial fraud that’s possible today. When you get stock, you’ll know you didn’t get double-issued stock.

Still, even with all that, you might not believe it because Bitcoin and cryptos have a lot of negative press swirling around them, so let’s look at a few of the most common arguments against them, just for kicks.

But…But Tulips

You know this story. Bitcoin is a Tulip craze and it has no value. Only fools and computer geeks see it as worthwhile.

This is such an asinine comparison. It demonstrates a complete lack of critical thinking. It’s nothing but a knee-jerk opinion formed after casually reading an article or two on Reddit and calling it a day. That’s not thinking. That’s a lazy mental heuristic, a poster child in the Illustrated Book of Bad Arguments.

Here’s the deal: Tulips actually had no inherent value. They were just flowers. They were pretty and that was about it.

Bitcoin is founding an entirely new method of frictionless transactions, spawning new decentralized app platforms that you’ll be using every day in three to five years.

Don’t believe that? Take Status for example. Status just raised $270 million dollars in an ICO to build a Decentralized WeChat. (FYI, it might be a $100 million, as the reporting on this ICO is all over the place.) Now people are right in saying that just because someone raises money doesn’t mean that has any value. You may hate or resent Status and think they suck. Doesn’t matter. But their approach is smart. That means it could very well be successful. The reason is WeChat.

WeChat isn’t that well known in the US, but it’s used by 890 million people in China and greater Asia. It started as a chat app but now it’s the ultimate mobile platform, with its plugins powering everything from buying tickets to comparison shopping to finding out how crowded an area is before you go shopping. People in China use it for every aspect of daily life.

The only problem is WeChat can’t really spread beyond China because it’s fraught with centralized control by an authoritarian regime. Decentralizing that trust will go a long way to revolutionizing mobile computing and bringing that power to the Western world.

WeChat is like Paypal / Slack / Stash / Viber / Facebook / Twitter / eBay / Instagram / Priceline / Hotels.com / Yelp all rolled into one.

If you think all ICOs are Ponzi schemes and you can’t see the potential in a decentralized WeChat then you can’t see the potential in much.

If Status is successful, that $270 million is going to look like a drop in the bucket.

Nerds!

But only nerds like cryptos!

You mean like when computer geek Jeff Bezos was starting a little company called Amazon to sell books on this thing called the Internet that nobody but nerds understood? I mean there are all these book stores I can go to, why would I need that?

Or how about when Steve Jobs and Woz were hacking together a computer in their garage?

What the hell is a computer people asked? Only nerds need that.

Neither the Internet or computers had much value then. But those pioneers were smart enough to see into the future, projecting out far enough with intellectual curiosity and seeing the potential while people still scoffed at them.

That’s what us geeks see in Bitcoin and cryptocurrency and blockchain right now, even if others are missing it.

But…But It’s Unstable

You know this story too. Cryptos are unstable. They can go to nothing overnight. You can lose a lot of money.

This argument tells you absolutely zero.

Anything can go to nothing over night.

Nothing is immune. Not central markets or decentralized ones.

Housing crisis anyone?

Stock market crash in the 20’s, 80s, 90s?

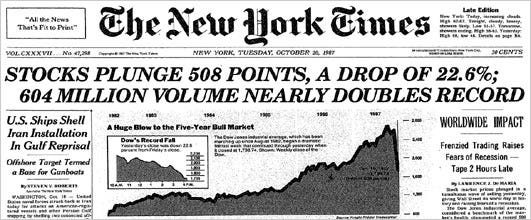

Here’s the Dow Jones over a 100 years to illustrate:

That is a long-term trend up. Awesome. But it’s not the whole story.

You see those big downward spikes? They’re really smoothed out on this long timeline, but those are times when people lost a lot of money. If you’re in one of those times, it can hurt bad. It looks a lot steeper zoomed in.

Let’s take a look. Here’s the zoom in on the 1920’s crash out.

Looks a lot different from that perspective, right?

How about this headline from the 1980’s crash, dubbed Black Monday, when traders came into work to find the market dropped drastically overnight?

That’s what trading is. High risk, high reward.

But while everyone else is worried about wild swings, traders love it. They know that downward spirals are opportunities while novices cry about market manipulation and unrealistically expect things to go up forever.

Bitcoin looks wild in the short term, and it is, but it’s long term trend is up.

Investing when everyone else thinks something is worthless, and hanging on tight when everyone else is losing their minds is how it’s done. That’s why Warren Buffet is rich and you’re not. He bought Coke when everyone else though it was going bankrupt. That’s what he does. That’s all he does. He finds good companies that are undervalued and buys them up while others are fleeing.

As Rudyard Kipling wrote in his famous poem If:

“If you can keep your head when all about you,

Are losing theirs and blaming it on you,

If you can trust yourself when all men doubt you,

But make allowance for their doubting too…

Yours is the Earth and everything that’s in it.”

But…But It’s Backed By Nothing

One of the biggest and most ridiculous claims against cryptos like Bitcoin and Ethereum is that they have no inherent value except that we believe they do. I can’t tell you how many times this shows up in comments on any article written on this subject. Read my lips:

Nothing has any inherent value except the value we put in it.

Well maybe food, water, shelter does, but beyond those basics, what else? Not much. Even gold and diamonds are just some shiny shit we dug out of the ground and we liked it because it shimmers. No real value and barely any utility.

Your USD is backed by nothing. It only has value because we all agree it has value.

But wait, you say, it’s backed by the US government. Sure, but what’s that really worth in a serious crisis? How’s that working out in Venezuela right now?

We tend to think of trust as a fixed trait. It’s not.

Trust is a moving concept.

If my government was stable for fifty years and then a bunch of morons get elected who do stupid shit, that trust is now worth shit, as is their backing.

A backing by a central entity is no guarantee of anything. At multiple points in history, currencies from major industrialized nations have gone into a tailspin despite that backing. Think Germany before WWI, which led directly to WWII.

It can even happen here. And it has.

J.P. Morgan once bailed out the U.S. Treasury because they were broke.

But this is the modern world you say. Nothing like that can happen again.

Sure.

Last I checked we’re only seventy years out of a war that consumed the planet, cratered multiple economies and currencies and killed 50 million people. That’s barely a picosecond on the grand scale of human time. If you think we’re so evolved since then, as multiple governments across the planet wage war on the post-world war alliances that have bound us together for seventy years, then I don’t know what to say other than you believe in fairy tales about human nature. Human nature is the same dark creature it’s always been and it can turn on us in a second.

But wait you say, the USD has inherent power as a store of value and a means of transacting business!

But Bitcoin and other cryptos are now more and more valuable every day as they fund companies through ICOs and through the thousands of decentralized apps that companies are building for them right now.

Tomorrow they’ll be even more valuable because they’ll power voting, gaming, issuance of shares and even security and reputation banks.

That’s a hell of a lot more valuable than just a means to buy Beanie Babies and iPads and Snickers.

Oh, and Bitcoin’s long-term trend is up. The US dollar’s long-term trend is down. It bleeds value little by little, slowly eroding your purchasing power like cancer eating away at you for years without you seeing or feeling it. It’s called inflation. One day you will wake up and find your dollar is worth a lot less than it once was because it’s designed to decrease in value over time.

Yesterday’s Snickers cost 5 cents. Today it’s $1. Tomorrow it will be $5. Your dollar is still a dollar.

Bitcoin and Ethereum are not just any other asset, like gold or silver or stock in a company.

They’re shares in an economy.

It’s just hard to see right now because it’s a banana republic economy.

But in five to ten years, it will be a third-world economy and then a second-world economy and then a first-world economy. And everyone will be wondering, why didn’t I see that coming? I wish I got in back then when everyone was missing the forest for the trees.

Imagine buying shares in the United States when the first settlers got here and swindled the Native Americans out of Manhattan.

What would those shares be worth today?

############################################

DISCLAIMER: Be a big boy or girl and make your own decisions about where to put your hard earned money. I am not a financial adviser and this is not financial advice and if I really need to tell you this then it’s best to keep your money in your pocket anyway.

############################################

If you love my work please visit my Patreon page because that’s where I share special insights with all my fans. Top Patrons get EXCLUSIVE ACCESS to the legendary Coin Sheets Discord where you’ll find:

Market calls from me and other pro technical analysis masters.

Access to the Coin’bassaders only private chat.

Behind the scenes look at how I and other pros interpret the market.

You also get exclusive access to a monthly virtual meet up with me, where I’ll share everything I’m working on and give you a behind the scenes look at my process.

I’ll follow each talk with a Q&A session. Ask me anything and I just might answer.

###########################################

If you love the crypto space as much as I do, come on over and join DecStack, the Virtual Co-Working Spot for CryptoCurrency and Decentralized App Projects, where you can rub elbows with multiple projects in the space. It’s totally free forever. Just come on in and socialize, work together, share code and ideas. Make your ideas better through feedback. Find new friends. Meet your new family.

###########################################

NOTE: I think several people are correct in pointing out (privately and in comments) that Ian Grigg’s triple entry system is more directly related to triple entry accounting as Bitcoin defines it and as I define it in this article. And Grigg is vastly more influential in the crypto community, as this video from Balanc3 at Consensys shows. This article should not be seen as taking away from Ian Grigg’s contributions or efforts or ideas. He deserves all the credit in the world. However, I feel that the concept of looking at accounting in three dimensions goes back to Yuji Ijiri in 1989, even if the substance of what he was tracking with that third dimension is different and even if it preceded much of the work that came about with encryption, so I feel it is a fair attribution. However, attribution of ideas is a tricky business because usually when an idea is ready to pop it is sitting out there in the collective unconscious and multiple people hit on it in different ways. As always people are free to disagree with me. Also, if you disagree with this, it’s only one point of many in the article, so try not the throw the baby out with the bath water. Then you’re just missing the forest for the trees again.

###########################################

A bit about me: I’m an author, engineer and serial entrepreneur. During the last two decades, I’ve covered a broad range of tech from Linux to virtualization and containers.

You can check out my latest novel,an epic Chinese sci-fi civil war saga where China throws off the chains of communism and becomes the world’s first direct democracy, running a highly advanced, artificially intelligent decentralized app platform with no leaders.

You can get a FREE copy of my first novel, The Scorpion Game, when you join my Readers Group. Readers have called it “the first serious competition to Neuromancer” and “Detective noir meets Johnny Mnemonic.”

You can also check out the Cicada open source project based on ideas from the book that outlines how to make that tech a reality right now and you can get in on the alpha.

Lastly, you can join my private Facebook group, the Nanopunk Posthuman Assassins, where we discuss all things tech, sci-fi, fantasy and more.

Hacker Noon is how hackers start their afternoons. We’re a part of the @AMI family. We are now accepting submissions and happy to discuss advertising & sponsorship opportunities.

If you enjoyed this story, we recommend reading our latest tech stories and trending tech stories. Until next time, don’t take the realities of the world for granted!