Let’s face it:

Crypto is dead.

Last year we saw a frenzied market soar to insane new heights before crashing off a cliff. ICOs that once raised $20 million in the blink of an eye now struggle to raise $1 million. Projects started failing left and right, their Github’s turning into ghost towns.

Regulators are cracking down. They’re driving out little investors and jamming the current system down our throats again. KYC, AML and centralized choke points are the norm.

Only accredited investors, aka already rich people, can invest and make more money from their money. Instead of allowing people to decide what to do with their own cash, regulators think the bus driver, the teacher, and the dock worker are too stupid to invest, so we better protect them from themselves.

As for trading, well, unless you’re an expert trader you’re probably bleeding out slowly or just holding on for dear life.

Last year anyone could throw a dart and make money trading. This year, after a painful ten month slide that saw 80% of crypto value vaporized, I’ve seen many of my trading students tapping out, their bank accounts on fire and their self worth plunged into the toilet.

But the worst part is that crypto hasn’t lived up to the hype.

Facebook and Google are still mega-monopolies and they’re not in danger of getting decentralized or democratized any time soon. The primary use case for crypto is still speculating or printing money out of thin air to fund new projects before a single line of code is written or a single customer signs up.

We’re not buying coffee with our fancy digital money or shopping on Amazon.

The unbanked are still unbanked.

And the vast majority of my money still comes through direct deposit, not smart contract.

Maybe you were one of the folks who thought “this time is different?” It’s not a bubble. It’s a new world order!

All we need to do is decentralize everything and we’ll throw off the shackles of eons of financial servitude and high step it into a bold new world of abundance and opportunity, a new dawn for mankind, a transformation of consciousness, a radical awakening of the species that’s happening right here and right now!

Well, you were wrong.

And you were right.

A bubble is a bubble and nothing can change basic physics. What goes up must come down.

But you were right too.

Crypto will change the world.

It’s just going to take longer than you expected. And nothing is ever all good or all bad. The dream of a brand new world where smart contracts create objectively fair systems is a pipe dream and it always will be because people still need to write those smart contracts and those people will always be flawed.

You can count on three things in life:

Death, taxes and people doing the absolute dumbest and worst things in the name of truth and light.

You can’t correct for the human element no matter how hard you try.

But does that mean we should stop trying? Does it mean the Dr Doom’s of the world are right and blockchains are nothing but overhyped, glorified databases and crypto is only good for drug dealers and scam artists?

No.

We live in a world of duality.

Something can be both overhyped and world changing.

AI failed to achieve any of its goals for fifty years and then suddenly it was powering everything from driving directions, to search engines, all while understanding your voice, and driving cars around busy city streets. Just like AI, crypto will reach a tipping point where the hype recedes and it starts to do real things that matter.

What will it take for the technology to live up to its potential, prove Dr Doom and the other doomsayers wrong, and become so useful that we can’t imagine what life was like before it?

In other words, what will it take for crypto to boom again?

Let’s dive in and have a look.

The Past and the Future

You don’t have to hate crypto or be blinded to its potential like Dr Doom to look at what’s not working.

Critical thinking is our best friend in life. Without critical thinking we can’t fix a damn thing. So let’s take a hard and honest look at crypto and see what’s not working so we can start thinking about how to fix it.

This isn’t the first time I’ve faced the problems in crypto. In my article, The Five Keys to Crypto Evolution, I talked about the major problems the crypto faithful need to solve for the technology to really take off.

Not one of those problems has been solved yet.

Blockchains don’t scale to Visa heights, there’s no killer app, we haven’t eliminated centralized choke points or any of the other things I listed there. And every single one of those observations still stand although Radix, the Lightning Network, and a few other projects are making strides on scalability. For this radical new technology to have any chance of changing the world we have to build a better mousetrap, not just deliver the equivalent of betamax and hope people will give up their DVRs.

Take killer apps, for instance. Try walking your mother through signing up for an exchange, getting KYCed, setting up two factor authentication, transferring money from her bank account, buying crypto, and downloading it to a wallet.

Now imagine you have to do all that just to run some crappy app on your phone.

It’s never going to happen.

I’d rather run two miles on broken glass than do all that just to get an app that gives me better restaurant suggestions.

Today, if you want to try out Instagram, you go to the app store, click install and a minute later you’re browsing pictures of shiny, happy people who are much cooler than you. Instagram doesn’t need any crypto to do anything at all. It makes its money from the surveillance device you willfully purchased, that’s in your pocket right now. It’s better known as your smartphone.

Your phone does advertising better than any advertising system of the past. It listens to your every word and uses AI to figure out what ads to show you, like that backpack or jacket you just talked about with your best buddy. That blows away billboards on the side of the road or flat text ads in the newspaper. Advertisers of the past never knew how many people bought a Coke after driving by that billboard twenty times but they know exactly how many ads you clicked on Facebook.

Until we have crypto apps that not only do everything Instagram does but does it better, all while creating a superior economic model to replace or augment that advertising juggernaut, not to mention giving you brand new features you can’t live without, the crypto app world is going nowhere fast.

That’s a tall order but that’s what we’re up against.

But that’s not even the worst of it. Ever since I wrote that article I’ve thought more and more about the problems facing crypto and they’re even bigger than I imagined.

That’s the bad news.

The good news?

I realized we’re missing something very simple that will help the community get to the next level faster.

And it’s something I never expected.

We have to look to the past, not the future.

Baby and Bathwater

I say we have to look to the past because we’ve done one of the dumbest things possible:

We’ve thrown the baby out with the bathwater.

Instead of looking at what worked before, we’ve tried to reinvent everything from scratch. That’s not only stupid, it’s impossible.

We can solve half the problems in crypto right now by simply stealing what worked from the past and making it work for the future.

Let’s start with ICOs.

ICO’s were an innovative way to quickly crowdsource funding for radical new ideas. They cut across legal jurisdictions, let every-day investors throw their money into the ring, instead of just accredited investors, and they didn’t require a bank account or a lot of crazy paperwork.

Those are real innovations despite all the scams and crappy projects out there. It’s essential to separate what works and what doesn’t whenever you look at the current state of the art.

Of course, it didn’t take regulators long to catch up with the innovations and destroy them. Soon projects were running scared, doing their best to comply with shifting regulations, KYC/AML, FACTA, and hoping they didn’t get indicted after raising twenty million dollars for a pipe dream.

Even worse, many investors lost their shirts as projects went belly up and their founders disappearing to foreign beaches with all the cash. The protections that regulatory agencies offered investors, like demanding transparency and making sure companies didn’t make outlandish claims of future rewards, started to look a lot less old fashioned.

ICOs had other problems too.

Certain types of coins are impossible to fund with an ICO. Most utility coins will never rise in value.

Why? Because utility coins will disappear into the background of applications and trade machine to machine. Think of them as programmable money for bots. They’re designed to buy and sell goods transparently behind the scenes without any human interaction whatsoever.

It’s crazy to think those coins will ever be worth as much as a deflationary coin like Bitcoin, which is fundamentally designed to rise in value as it grows more and more scarce.

And that’s not the only other kind of coin that sucks for funding with ICOs.

Stablecoins, designed to hold their value by tying that value to a basket of external factors or assets, don’t hold much value for investors. We all want a simple stablecoin to rival Tether but who’s going to spend their hard earned Bitcoin and Ethereum on an asset that not only won’t rise in value, it’s specifically designed not to rise in value?

The answer is a simple one.

Don’t bother selling your coin directly to the public, sell a security token instead.

(Oh, and create an LP, aka a Limited Partnership option, that doesn’t give the investors a security token, just rights in the company. Traditional, old world money investors love LPs because they understand them inside and out and security tokens still scare the living hell out of them, even though in five to ten years nobody will want a pure LP unless they’re insane, because it offers less liquidity and less rights than a properly designed security token.)

That’s right. Create a company and follow the rules that actually worked. Give people the investor protections they crave, and voting rights, and a share of profits.

Then use that company to issue the kind of coin you really need to power your application.

Newer projects are already following the model. And there’s good reason to do it.

You can’t sell a stablecoin directly to the public. Well, you can try, but you won’t raise much money for all the reasons we talked about earlier. It’s never going to go up in value so who wants to buy it?

But you can sell the company that owns that stablecoin to investors and then build the stablecoin the way you always imagined it. The company will need to make profits from something other than speculation but that’s a good thing. That’s the way it should be because it means profits are no longer tied to the whims of fickle traders who dump one coin for another faster than they can say “shitcoin.”

There are any number of ways that a company can make money, from getting paid to provide liquidity, or with fees for atomic swaps, or from sharing transaction fees with major exchanges, or with crafting a robust economic ecosystem of buyers and sellers like the Amazon marketplace, along with a thousand other ways we’re only just starting to figure out.

As soon as the crypto community realizes that not everything from the old financial system is evil, they can start to pull the good from the old system and leave the bad on the chopping block.

It’s impossible to completely reinvent the wheel.

So why are we trying?

It’s better to iterate and let those iterations lead to innovations.

The British Tea Company, a Catalogue Company and the Railroads that Changed Reality

There are lots of other ways to iterate on the past, instead of just forgetting it even existed.

Let’s take a closer look at DAOs (Decentralized Autonomous Organizations).

DAOs promised to reshape how we do business, how we organize and incentivize labor, and how we make and distribute goods but it hasn’t happened yet because we’re not looking at the organization that already does those things exceedingly well:

Companies.

No organization in human history has changed the very nature of reality more than the corporation.

If you want to design a DAO, you don’t have a prayer unless you go back and look at what already works and what doesn’t before you try to make it better.

The rise of the modern corporation is the place to start. Before joint stock companies, the stock market, limited liability and all the traits of modern business we take for granted, it was nearly impossible to change the world. As Yuval Harari pointed out in the amazing book, Sapiens, people believed in the past and not the future. Life stayed pretty much the same, year after year, decade after decade, century after century.

The kings and queens had the power and the money and they passed it down to their children. If you were a peasant, you stayed a peasant, and your children stayed poor, and their children stayed poor.

Imagine you’re a young, enterprising peasant in the middle ages with dreams of opening a bakery and bootstrapping your way into the middle class. Your chances of making that happen were close to zero.

Where would you get the money? Who would lend it to you?

There were almost no banks, certainly no investment houses and no way to get a loan at reasonable rates. If you were lucky, maybe someone in your family knew someone, who knew someone, and you could go to the local lord and get a loan with an interest rate that would make the modern mob envious.

Nobody wanted to take a risk on the future. It wasn’t like it is today where life changed dramatically every decade. A hundred years ago people still fought war with horses. A hundred years before that they fought wars with horses too, and a hundred years before that.

But by World War I, we had prototype tanks. By World War II, we had tanks and airplanes, both of which utterly obliterated any and all strategies of old. Horses were obsolete within a few decades after dominating the world for centuries. Tank beats horse every time.

Twenty years ago, few people used a computer or the Internet. Today, can you imagine doing anything without it?

We have every reason to believe that tomorrow will be different than today. But in the past, nobody had any reason to believe that because life stayed the same. Your father was a farmer, and his father before him, and his father before him.

So if you’re a man of money why bother lending money to the local peasant to start her bakery? You don’t have the imagination to see that bakery flourishing and filled with customers because you’ve never seen a single example of it in your entire life. If you’ve never seen a black swan, why bother believing there’s one out there? Better to put your money in a safe and protect it at all costs.

But corporations changed all that.

For the first time they allowed us to share risk. Investors could pool their money together and if things went wrong they had limited liability. The kings and queens couldn’t send their soldiers to blame you for a shipwreck that never made it home from a long distance voyage and drowned all the sailors on board. Your risk was your capital. The ship’s risk was the crew and the profits.

Shared risk made the modern world.

Most people don’t bother to study the history of the company and it’s a shame. Start with the excellent book The Company: A Short History of a Revolutionary Idea, by Micklethwait and Wooldridge, and go from there.

Early corporations like the Dutch and British East Indies companies pioneered long distance trade, brought spices and goods from near and far, and revolutionized how we financed big and ambitious ideas in ways the kings and queens of old could only dream about in their wildest fantasies.

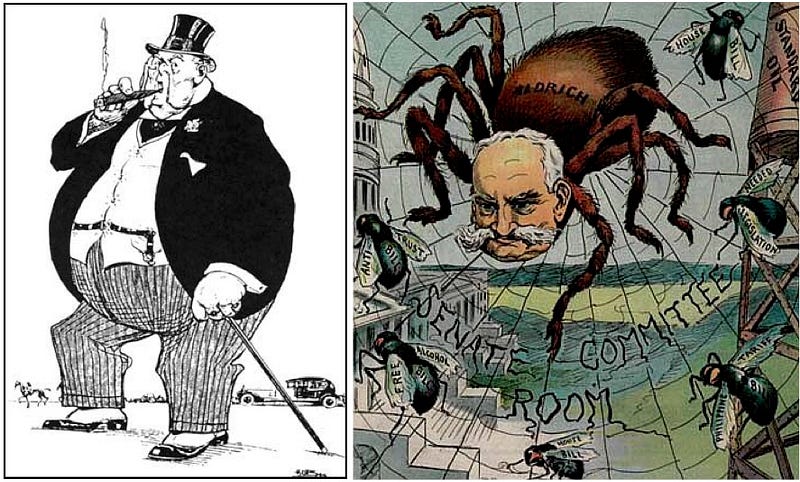

Of course, early corporations weren’t just a force for good. We often complain about the power of corporations today, but they’ve got nothing on the titans of the past.

The British East Indies Company pioneered long distance trade, but they also “pioneered” slavery and monopolies. They managed to colonize India with a private army that was double the size of the British army, all while torturing and exploiting local farmers, fixing prices and locking out competitors.

Try to imagine even the most powerful private military corporation of today deciding to take over a country the size of India. They’d be shut down almost as soon as it hit Fox News and CNN.

Like everything in life, the companies of the distant past existed in duality, both good and evil. They had good ideas and bad ones. Later companies took the good and left most of bad on the chopping block. A newer and better generation of companies built the railroads, created many aspects of modern democracy, and changed the way people bought and sold everything from food to household goods.

Sears Roebuck sprang to power in 1892 selling watches. A few decades later their catalogue stretched to 500+ pages selling everything imaginable. Their goods flowed along the revolutionary new railroads to small towns and villages all across the United States. Before that people were limited to whatever their local artisan made, but now they could open the Sears catalogue and order a finely made watch from a master craftsman thousands of miles away.

Sears also pioneered logistics and supply change management and armies of managers and employees. The company that powered the Sears money machine differed radically from John Jacob Astor’s fur company that made him American’s first multimillionaire.

Astor’s company, started only fifty years before Sears, employed nothing but a handful of clerks, even as he racked up $80 million dollars in personal fortune, about $2.2 billion by today’s standards.

But Sears changed all that. Each part of the company became a network unto itself. It employed thousands of people to manage shipping, returns, support, brokers, dealers, people, vendors and factories.

In short, they pioneered automation.

The corporation is responsible for so many of the things you take for granted in your life today, from the chair you’re sitting on, to the computer I’m typing on, and even the coffee I’m drinking as I sit in a cafe writing.

But in crypto we’ve completely given up on the things that worked in the past. Decentralize everything is the call to arms! Replace corporations with DAOs! Get rid of hierarchies, managers, logistics and bosses.

We imagine that a simple smart contract that fires out a couple Ethereum based on a trigger is enough to replace generations of advancement and innovation created by companies.

Can a smart contract hire and fire people?

Can they change product lines and marketing and direction?

Can they motivate people to move in the same direction?

The more I’ve looked at DAOs the more I wonder if they’re at least a decade away, if not multiple decades away. They’ll need so much more than smart contracts to compete with the titanic companies of today, like Apple, Amazon, and Exxon Mobile. Walmart employs more people than most medium size countries.

DAO’s will need to completely reinvent how we incentivize and punish people, how we make decisions, and how we channel people’s attention and get them motivated. They’ll need to change everything from how we order pencils and paperclips, to how we deal with regulation and paperwork.

In short, they’ll need to do all the tasks corporations already do and then do something else even better if they have any chance to compete.

They’re not even close.

I look around and I look around and not one of the DAO projects I’ve seen has the answers yet. It might just be because those answers will come from technology we haven’t invented yet and can’t see coming. But whatever it is, we’re not there yet.

As soon as you look back at the history of the company you realize just how far the crypto community has to go. That doesn’t mean we won’t get there, it just means it might be a longer road than anyone expected.

As we learned in Shawshank Redemption, when you want to change something “all it takes is pressure and time.”

The pressure is there.

The time is still ticking.

From Crappy Wallet to Killer App

Let’s face it, almost nothing in crypto is ready for prime time.

From the crappy wallet interfaces, to the insanely complicated process of buying and selling crypto, to the applications that barely work, to DAOs that don’t do much except send and receive money based on brute force triggers, while punting on solving the real problems, we’ve got a lot of ground to cover.

But that’s very different from saying crypto won’t ever cover that ground.

That’s what the doomsday critics don’t get.

Their view is black and white. It’s all or nothing. Either crypto will completely fail or completely succeed. There is no middle ground. It either solves every problem of mankind or it’s worthless.

That’s not just insane, it’s stupid.

It’s not how anything works. Life moves in stages. Your DNA incorporates the entire history of the all the iterations that came before you, all while trying something new.

The answer to crypto’s problems lays with that same iterative process.

Think evolution, not revolution.

It’s the evolution that gets us to the revolution. Revolutions aren’t just a big bang, they were happening little by little over a huge period of time, the force building like a wave far out to sea, gathering steam as it rushes the shore.

The revolution will come.

In it’s own time.

Nobody can push the river and get us there any faster.

In the meantime, start looking to the past. Look to change things step by step, inch by inch.

Do that and crypto might just start living up to the hype.

Crypto is dead.

Long live crypto.

###########################################

If you love my work please visit my Patreon page because that’s where I share special insights with all my fans.

Top Patrons get EXCLUSIVE ACCESS to so many things:

Early links to every article, podcast and private talk. You read it and hear first before anyone else!

A monthly virtual meet up and Q&A with me. Ask me anything and I’ll answer. I also share everything I’m working on and give you a behind the scenes look at my process.

Access to the legendary Coin Sheets Discord where you’ll find:

Market calls from me and other pro technical analysis masters.

The Coin’bassaders only private chat.

The private Turtle Beach channel, where coders share various versions of the Crypto Turtle Trader strategy and other signals and trading software.

Behind the scenes look at how I and other pros interpret the market.

############################################

I’ve got a new podcast, The Daily PostHuman, covering crypto, AI, tech, the future, history, society and more! Check it out for expanded coverage of my most famous articles and ideas. Get on the RSS feed and never miss an episode and stay tuned for some very special guests in the next few months!

############################################

A bit about me: I’m an author, engineer and serial entrepreneur. During the last two decades, I’ve covered a broad range of tech from Linux to virtualization and containers.

You can check out my latest novel, an epic Chinese sci-fi civil war saga where China throws off the chains of communism and becomes the world’s first direct democracy, running a highly advanced, artificially intelligent decentralized app platform with no leaders.

You can get a FREE copy of my first novel, The Scorpion Game, when you join my Readers Group. Readers have called it “the first serious competition to Neuromancer” and “Detective noir meets Johnny Mnemonic.”

############################################

Lastly, you can join my private Facebook group, the Nanopunk Posthuman Assassins, where we discuss all things tech, sci-fi, fantasy and more.

############################################