The Cryptocurrency Trading Bible Two: The Seven Deadly Sins of Technical Analysis

So you read the original Cryptocurrency Trading Bible and you jumped head first into the great game?

So you read the original Cryptocurrency Trading Bible and you jumped head first into the great game?

How are you doing?

Be honest.

Are you making money or losing it?

There’s only one metric in trading. You either win or lose. It’s simple. There is right and wrong and it’s not hazy like real life.

Right is making money. Wrong is losing money.

If you’re losing money and you’re still telling yourself you’re good at trading you’re straight up lying to yourself.

You were up 100% but gave it all back four weeks later? Then you failed. Simple as that.

But don’t worry. I’ve been there. Everyone has. Nobody is immune.

These are hard lessons but there is only one way to learn them:

By making the mistakes yourself.

Nobody gets to skip steps. Mistakes are part of learning. You can read every trading book, meticulously paper trade in an Excel spreadsheet for a year and you’ll still jack it up with real money when your ass is on the line. Nothing matters until you put skin in the game and risk your own cash. Not until your blood is pulsing and your heart thundering and waves of fear sweep through you as you watch money vaporize on a horrible trade will you learn a damn thing.

It’s only by doing that we learn anything in life.

Reading books about trading, going to seminars, talking to friends, thinking about trading is not trading. Trading is trading. You have to risk your own hard won money to understand.

That’s because trading and life are a journey of self discovery.

It requires peeling away all that is false and fake. When you lose money it requires painful self analysis to figure out where you went wrong.

Did you get swept up in FOMO?

Did you HODL for too long?

Did you try to catch falling knives?

Did you buy the tip instead of the dip?

Was your stop loss too tight?

Lying to yourself is the first enemy of traders. Society rewards people for deluding themselves. It rewards them with community, a job, friendship and a card at Christmas from someone they don’t really know. But trading punishes deluded people by taking their money from them as fast as possible.

Each person sucks at something different. You’ll have to figure out where you suck on your own. Nobody can do it for you.

One of the lessons I had to learn was that I just wasn’t very good at technical analysis until recently.

Oh people thought I was pretty good. I could put together a pretty chart with the best of them and draw some fine looking lines on it. But in my heart of hearts I knew I wasn’t that good. Even worse, some of the traders I talk to thought I was pretty damn awesome at it and that compounded the lie I told myself. It made it much harder to spot. The dopamine hit of people liking you can distort your thinking in all kinds of terrible ways.

That’s one of the hardest thing about discovering lies. People can love your lies. They can be totally blind to your lack of skill because they’re blind themselves.

Then one day you wake up and realize you’re the blind leading the blind.

You suddenly see the signs of your suckitude all around you. They were hidden in plain sight. Maybe you’re entering trades too early instead of waiting for breakout confirmation or your mind is filling in patterns that just aren’t there or you don’t really know what the patterns mean or you can’t get out of a trade without giving back 75% of it every time? The possibilities to lose money are endless. That’s what makes this game so wonderful and maddening at the same time.

As a trader you have to see your mistakes fast or you’ll just dig yourself a deeper and deeper hole.

The best and only way to do that is to lose money.

Wait, what?

Yeah. Get in there and lose money.

There’s an old saying in the ancient Chinese game of Go:

“To get good at Go, lose your first hundred games fast.”

You have to feel the pain of loss to understand that you never want to feel that again and the only way to stop the pain is to improve. Failure is your teacher.

Thomas Edison had thousands of failures before he found the perfect material for the electric light. One day his exasperated assistant shouted: “Why are we still doing this? Why are you wasting your time and money? We’d had failure after failure. It’s impossible.”

Edison told him: “We haven’t failed a thousand times. We’ve just discovered a thousand ways not to make the electric light.”

That’s what this article is all about: How to screw up. Hopefully that will help you avoid some of my stupid moves.

You’ll still have to make a lot of the same mistakes yourself but maybe, just maybe, you’ll look back on this article after burning thousands of dollars (or worse) and suddenly remember something you heard here and it will accelerate your chances of course correcting and finally getting it right.

So let’s dig in and check out the cardinal sins of trading with a focus on technical analysis (TA).

Screw Up One: Thinking TA is Magic

You will find no shortage of articles telling you technical analysis is the path to instant riches or complete bullshit. It’s one or the other.

This is binary thinking. Binary thinking is literal insanity. It’s the mark of stupidity. Writers call it black and white insanity. There is no room for religious zeal in trading. No system is perfect but every system has something to teach you. A system is only as good as the practical results it delivers. People’s opinion on it means nothing. Take what works from every system and leave the rest behind but don’t throw the baby out with the bathwater.

Technical Analysis is just another tool.

It’s not a path to unbounded glory and it ain’t complete bullshit either. It’s somewhere in between. It serves as one guideline to help you make money.

When it comes to cryptocurrency, technical analysis holds more weight because it’s dominated by a lot of techies and that makes it a self-fulfilling prophecy. TA makes sense to techies. With other markets your mileage may vary.

The problems start when you rely on TA so much that you shirk common sense.

One of the problems I discovered in my own trading was denying basic gut feeling and logic. I kept looking for a magical indicator that would indicate a perfect reversal every time.

That indicator doesn’t exist.

I found myself staring at a chart after watching five or six days of nonstop gains and thinking: “I have to get out. It’s gone up 60 or 70%. It has to fall back to Earth.” But the indicators didn’t seem to line up with that so I would stay in a trade and lose a lot of money.

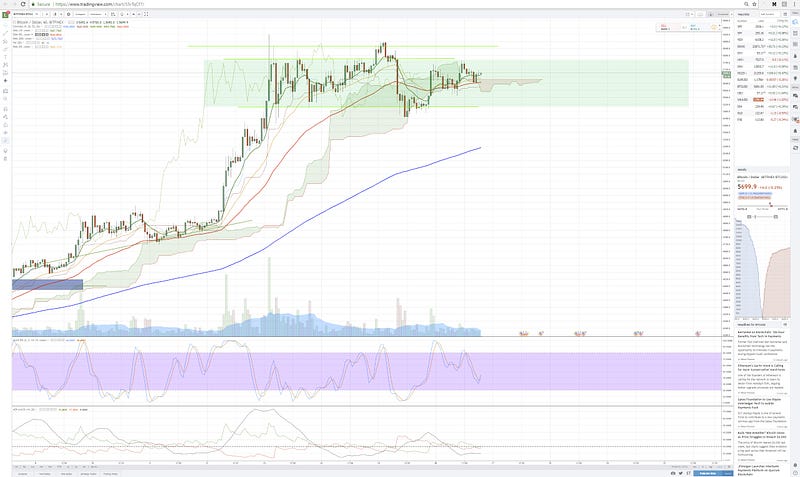

Maybe that stock is at an all time high and still showing a bull flag (see chart 1)?

So what? A pattern must be seen in context with other factors.

Did Bitcoin already run up a thousand bucks and you still think it’s poised to run up another thousand the very next day? It just doesn’t make sense. What goes up must come down.

After trading for a bit you will get a better sense of the market. Much of that is common sense. Three or four days of rocket speed gains probably means a reversal.

It’s not magic. It’s basic human psychology.

The mistake is trying to time it perfectly. You can’t and you never will. Forget about it.

You just have to get out and take profits off the table if you’ve done well. If you lose, cut your losses. Sounds simple. It’s not.

Yes, you will miss some of the upside. Who cares? Nobody gets the top and bottom exactly.

You eat the body but leave the tail and the head.

If you never bank your profits you didn’t make any profits.

Screw Up Two: Overcomplicating Everything

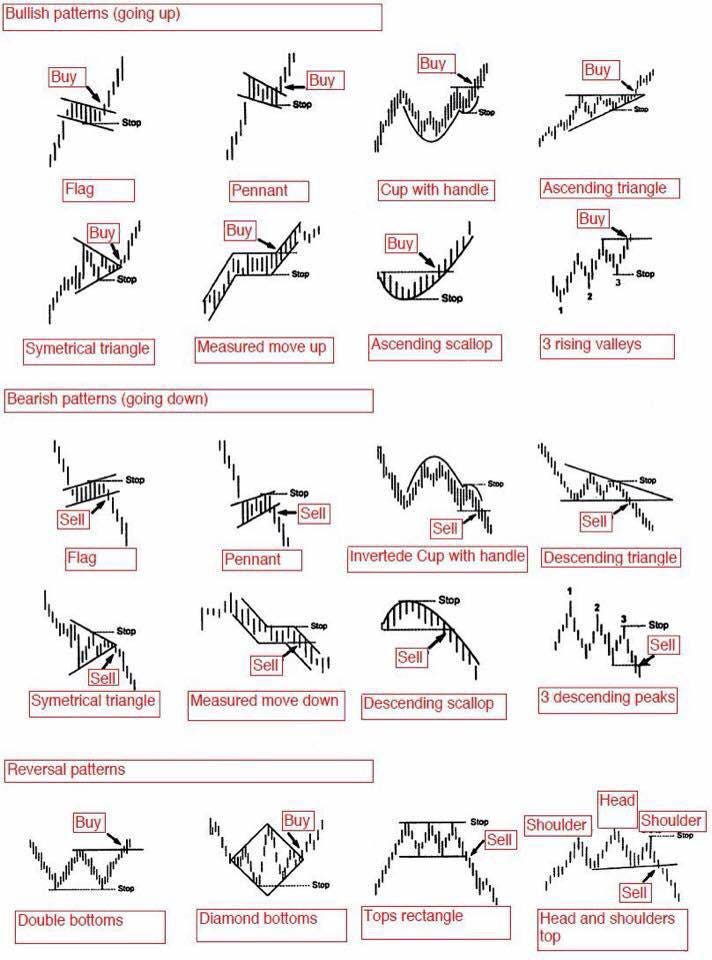

There are lots of books and sites out there to learn chart patterns.

Want to discover the secret, ancient mysteries of Japanese candle stick charting?

How about putting yourself through a deep dive on becoming a trader with a self-paced online training system?

Maybe you want to know every pattern ever discovered?

Stop it.

The problem is that pretty soon you’re seeing patterns in passing clouds and looking for reversals in gusts of wind. Patterns, patterns everywhere.

Most of the patterns are total nonsense. They have success rate of about 5% over a coin flip. That is not very good.

You’re better off keeping it simple. Learn the basic patterns and learn them well.

Check out this course from Baby Pips on elementary patterns and indicators.

In fact, forget the rest of the course for now. Just learn those basics. Practice them. Figure out how to deploy them effectively.

If you get on a site like Tradingview there are thousands of indicators. Pretty soon you’re stacking them all onto a single chart. Forget that. It will only confuse you.

Figure out moving averages, stochastic RSI, trend lines and the basics of candlesticks, upwards and downwards channels, bull flags, breakouts and wedges.

Forget everything else for now. Just forget it. Most of it doesn’t work or is too rare or is too hard to read.

Keep it simple.

Screw Up Three: Seeing Imaginary Patterns

One of the mistakes I see way too often in new traders is a tendency to memorize a hundred patterns from bull flags to head and shoulders and reverse head and shoulders only to find them everywhere.

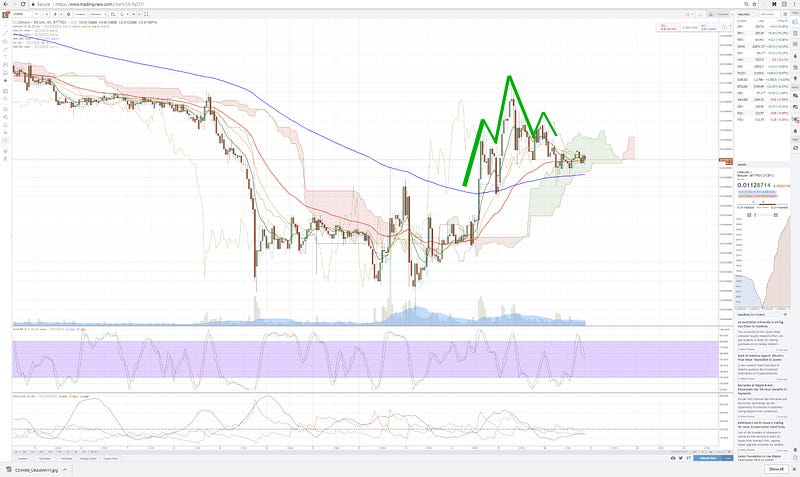

When they can’t see them in the one hour charts, they zoom in to the five second chart and find a pattern there (Chart 2). If the pattern doesn’t really fit they just jam it in there anyway, smashing a square peg into a round hole.

The other way this manifests is when there is no clear pattern yet but you find one anyway.

Patterns take time to develop.

Some days there are just no trades to make. You have to stay out of the game or wait for the pattern to come into focus.

The second way this shows up is when traders pile all kinds of lines onto their charts in lieu of a real trend.

The question is how does that help you make a decision? If you’ve outlined five ways a coin can go north and five ways it can go south what good is that?

Your goal it to correctly predict the next price trend not state the obvious that it can go in any direction.

If you can’t predict anything or make a good decision from what you’ve charted, you’re wasting your time.

Screw Up Four: Favoring Short Term Patterns Over Long Term

Long term patterns are much easier to trade than short term ones. A short term pattern can easily be a mirage. But a long term pattern that develops over weeks or a month holds a lot of weight.

You should look at what a coin is doing over a week, a few weeks, a month, three months, a year. The more you pull back the more obvious some patterns become.

I have found that more than anything, a few basic trend lines at the top and bottom of the chart are mostly all that I need.

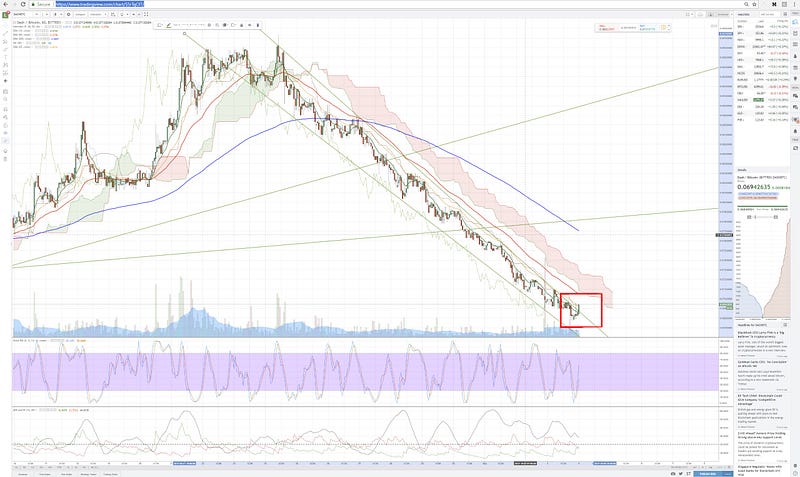

Channels are your best friend in charting. Learn channels. Seriously. It may actually be the only thing you need to know in TA (chart 4).

Almost everything is a channel the closer you look. Head and shoulders? Channel. Cup and handle? Curved channel. Rising wedge? Channel.

If you pull back to a month on a typical coin you will see a very clear tunnel going up or down. Patterns that look crazy and erratic will blend in to the larger pattern and that’s what you want.

You want to ignore the outliers and see the general movement of the coin. Don’t worry about a few blips just outside the lines of the channel. Nothing is perfect. Try to connect three or more points. Two connected points is not a trend, it’s a guess.

There are only three major types of channels: up, down or sideways. Seems obvious and it’s often overlooked because it seems so simple but simple is better when it comes to trading.

Simple is actionable.

Complicated is not actionable.

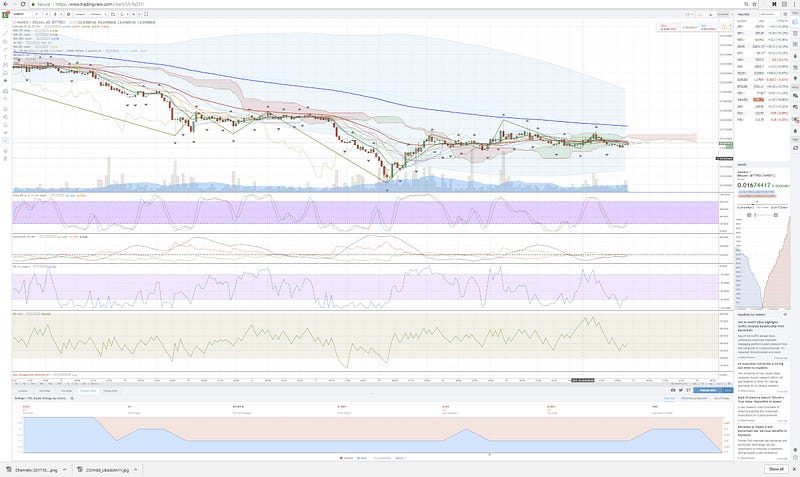

If a coin has gone down for a month in a channel and it suddenly breaks out of that pattern, pay close attention. Be patient and wait for it to confirm a change. Don’t try to catch that first breakout, as it could fall back into the overall downward slope (chart 5).

The same is true of upward channels. When you start to see a stock slowing down and not hitting the top or bottom of the channel after a strong and steady climb, it’s time to get out.

Reversals to the downside happen faster, while uptrends tend to move slower before taking off like a rocket. Don’t get caught in that downtrend. Just get the hell out when a coin starts to slow in its upwards channel.

Sideways channels are the most challenging. They let day traders try to catch small single day swings within the action of the channel for small gains, but they’re more dangerous.

I’m always looking for a coin to fall out or leap over a sideways channel. If the coin then falls back to the top of the channel and the ceiling becomes the floor, then you might just have something there.

The most important take away is this:

When a coin is trading in a channel for an extended period of time and it suddenly breaks out of that channel up, down or sideways, pay close attention.

The game just changed. Get your fiat ready or get out of the game for a bit.

Screw Up Five: Overtrading

This one is a classic. Everyone makes this mistake. I was not an exception and you won’t be either. Guaranteed.

Look, it’s exciting to make money. Once you rake in a 40% gain the pleasure chemicals in your brain explode across your skull making you high. You want more, so you rush back in.

It’s also terrifying to lose money. When the market turns against you the fear squeezes your throat and you’re sweating, your blood pumping hard in your veins. You rush to dump before you lose anymore.

Before you know it you’ve moved in and out of five trades in a single day or over a few days, burned up a ton of money on brokerage fees and gotten nowhere.

This is a massive mistake. It’s probably the biggest one early traders make and I was certainly guilty of it again and again.

The fool hears the truth a million times and never gets it. The wise man only has to hear it a hundred thousand times before he get it. That means that even fools and kings have to make the same mistakes a lot. There is no escaping it. The difference is whether you wake up one day and realize you were doing it or just keep blithely throwing your money down the toilet.

Emotions will screw you up bad in trading. They make you delusional. You need to ignore these delusions and focus.

Stop looking for tiny short term patterns, especially if you’re just starting out.

Look to get in and out every few weeks or every month.

Those longer term moves are easier to see and it’s a lot healthier for you too. You won’t have to stare at the damn charts all day driving yourself nuts with phantasms that aren’t there at all. It’s a lot easier when you don’t have to spend eight hours a day staring at the screen.

Screw up Six: No Margin of Error

This one is the worst. It’s so subtle. It sneaks up on you after you made a bunch of money and stabs you right in the throat.

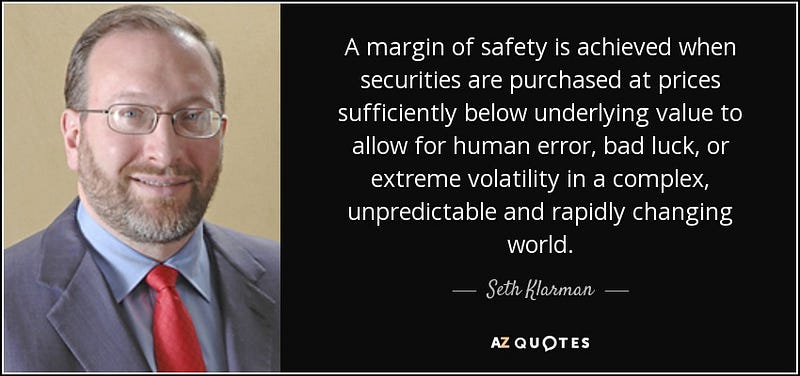

In one of the classic trading texts from the early 90’s, Margin of Safety, Seth Klarman lays out the ultimate guideline for top notch traders:

Give yourself a margin of error. A BIG one.

The book is out of print and goes for hundreds or thousands of dollars but you don’t need to cough up that much money for a book that tells you everything right on the tin. Put that money into the market instead.

Here’s everything you need to know about the book:

Burn that sentence into your brain.

Just let it sear into your eyeballs.

Once you understand that graphic you understand the essential lesson of buying and selling crypto or anything else really.

It’s not the only strategy that works but it’s one of the best for your pocketbook and your blood pressure.

The most basic pattern to look for in trading is when the market has bombed so bad that people are panicked and a coin channels down for a month or more or drops big time fast and loses a huge amount of its value. That’s when you want to buy and pretty much no other time. When there is blood in the streets, you should be happily buying.

The buy signal after a bloodbath is usually the most basic one imaginable. A downward channel suddenly turns sideways. That is a sign the market has had enough carnage. If it goes sideways for a few days, that’s where other traders start wondering if this is it and it’s time to get back in. Eventually it will be and that’s when you jump in again.

The other pattern to look for is when a coin has a long and steady climb and then suddenly shoots straight up. That massive green candle is almost always the end of the bull run. When Bitcoin or an alt coin shoot straight up like a rocket, ride it for a day or so and then get the hell out.

Don’t worry about trying to catch the whole run. It’s pointless. Just get out. It will come crashing down again.

The reason you want to do this is that nobody can really predict the market perfectly. When you have to be right on Bitcoin within fifty dollars or one hundred dollars it’s a bad trade. Bitcoin can move $500 or a $1000 in a week or a few days! Having a margin of error that gives you $1500 difference or more between you and the last all time high is the golden goose. It gives you so much room to be wrong.

A $500 margin of error is pretty awesome too. When it starts to climb $500 and crashes down you won’t have to worry about a stop loss because it’s almost never going to crash down lower than where you bought it. Once it climbs a $1000, even a $700 pull back won’t scare you. You’ll fear no bad news out of China or the mouth of Jamie Dimon. You’ll just hold, knowing you have a lot of room to screw up.

Give yourself and the world a chance to go crazy. You don’t know when or why it will go nuts but it always does somehow, whether it’s bad news or a panic or a sudden reversal for no reason because of sun spots.

The opposite of margin of error is trying to catch a trade after one of those rocket run ups. Bitcoin may hang out at the top of that run for days but it’s only a matter of time before it crashes out. Stop trying to guess whether it has another $200 burst. That is Russian roulette. Don’t do it and you’ll find you start to make money.

Screw Up Seven: Going All In

Trading is not poker. Get that out of your head right now.

If you start pushing your entire stack of money into a few coins again and again you’re playing with fire.

I can’t tell you how many times I did this because it’s such an easy mistake to make. It goes something like this:

You spot your first bottom up reversal. A coin lost 50% of its value over the last month and now it looks like it’s finally out of its downward slide and turning sideways or maybe even bursting up. So you listen to the gurus and you place a small amount of your money on the coin, something like 5% or 10%. Then the coin takes off running and you pile in a little more. So far so good. But before long you’re thinking “I should have gone all in from the very beginning and I would have so much more money right now.”

And that’s exactly what you do the next time. You go in with 100% of your cash.

Maybe it works once or twice.

But then suddenly it doesn’t.

You didn’t spot the bottom or some bad news destroyed the start of a nice uptrend. It starts sliding further and suddenly you lost a bunch of money.

Be happy with smaller gains. Don’t risk everything and you won’t lose everything at once.

Start small, grow big.

Slow and Steady Wins the Race

Turtle traders make money in the long run. Rabbits lose money.

When you hear about some guy or gal who’s up 1000% in two months you can rest assured they will be down 1500% the next month. Big risk and eventually big losses go hand in hand.

But if you stick to a more conservative strategy, keep it simple and don’t go crazy with every fancy indicator you can find, and buy when the market is bloody, you can make money trading. It’s not easy but it can be done.

And if you stick with it long enough you might even make a living do it.

When you get your charting right, you’ll know. You’ll make predictions and see the market play out exactly like you thought it would. You just need to predict the general direction, not try to perfectly figure out all the ups and downs which is totally impossible.

Check out this Ethereum chart where I predicted a drop and a bounce (chart 12). Notice how a few days later it came right down to where I predicted, plus or minus a few points and then hugged the line on its climb back up (chart 13).

That’s a wonderful feeling.

It’s even better when you begin to trust yourself and actually start buying those dips and making some good money.

Trading is a lesson in humility. It’s a journey into self. You need to figure out all your strengths and weaknesses. There is no room for lying to yourself. It requires fanatical adherence to the truth. It requires constant reassessment.

There is no final destination in learning about yourself. Nobody ever arrives in the journey of life and trading.

There is always more to learn.

Life is a river. Don’t push the river. Ride the river. Learn whatever it has to teach you right now and don’t worry about the past or the future.

Become a perpetual student, study with humility, ruthlessly correct your own screw-ups and you just might end up with a nice pile of money when this is all said and done.

Good luck. Happy trading.

############################################

DISCLAIMER: Be a big boy or girl and make your own decisions about where to put your hard earned money. I am not a financial adviser and this is not financial advice and if I really need to tell you this then it’s best to keep your money in your pocket anyway because when you lose it you will blame other people for your mistakes rather than yourself.

############################################

If you love my work please visit my Patreon page because that’s where I share special insights with all my fans. Top Patrons get EXCLUSIVE ACCESS to the legendary Coin Sheets Discord where you’ll find:

Market calls from me and other pro technical analysis masters.

Access to the Coin’bassaders only private chat.

Behind the scenes look at how I and other pros interpret the market.

You also get exclusive access to a monthly virtual meet up with me, where I’ll share everything I’m working on and give you a behind the scenes look at my process.

I’ll follow each talk with a Q&A session. Ask me anything and I just might answer.

############################################

If you love the crypto space as much as I do, come on over and join DecStack, the Virtual Co-Working Spot for CryptoCurrency and Decentralized App Projects, where you can rub elbows with multiple projects. It’s totally free forever. Just come on in and socialize, work together, share code and ideas. Make your ideas better through feedback. Find new friends. Meet your new family.

############################################

Here’s the list of traders I follow on Twitter. It’s a small list. Your list should be small too or else you will just get lots of conflicting signals.

############################################

A bit about me: I’m an author, engineer and serial entrepreneur. During the last two decades, I’ve covered a broad range of tech from Linux to virtualization and containers.