One of My Best Friends Passed Suddenly and It Got Me Thinking About Crypto

One of my best friends died suddenly and it got me thinking about crypto.

One of my best friends died suddenly and it got me thinking about crypto.

Maybe that sounds strange but Peter was the guy who got me into digital currency in the first place. When I dismissed it as nothing but stupid, Internet nerd money, he convinced me that it was something much, much more. We bought our first Bitcoins together.

At $13.

We had a long debate about whether that was too expensive.

Despite my deep technical experience, Peter was always ahead of me when it came to trying out new tech. He dove in fearlessly and never worried if it went wrong. I thought crypto was ugly and messy, so he bought the coins on the only exchange that existed, Mt Gox.

I put in $1500.

Of course, you probably know how this story turned out.

Mt. Gox got hacked and we lost them all.

It was the early days of the crypto dream and nobody knew how to do proper security. My coins and his vaporized with everyone else’s. He had a lot more. I did a quick calculation and at today’s prices mine would have been worth more than 1.3 million dollars. His probably had 10 million, maybe more.

I was bitter for almost a year after that and refused to think about crypto but my fascination never really went away. I would sneak a peak at the news or the price sometimes and Peter and I would talk about it. Where was it now? What would it look like when it really changed the world? Would it get corrupted by centralized powers? Would panopticons eat the world or would truly decentralized cash set us all free?

Over the last year I’d hit another one of the those saturation points where I didn’t want to think about crypto. Frankly, I was just sick of it in 2019. I’d said almost everything I wanted to say about it. I’d written about trading, tons of different promising projects and coins, threats to the ecosystem and the five things that needed to change to rocket the tech into the mainstream. But I didn’t have anything new to say.

When crypto crashed in 2018 I saw it as an immensely good thing. When the hype dies off, shitcoins and scams get swept away, and real projects can get back to work without the Eye of Sauron watching them. They can do their work in peace and private. Crypto threatens centralized money and power and with the price going supernova in 2018 it caught the unwanted attention of governments and the psychotic everywhere.

And when governments are afraid they lash out like they did at e-gold, crushing a promising early adventure into private money.

The crash was the best possible thing to happen to crypto. The imperial dynasties of the world turn their attention elsewhere, smug in the feeling that they’d put down the tiny rebellion with barely a shot fired.

Now with the corona crisis, protests, riots, refugees, broken economies and rising authoritarianism in the world, the powers that be have other problems. Crypto isn’t even on their radar and it won’t be for some time.

But crypto has its own problems.

Every coin went down for the count in 2018 and stayed down. Projects flamed out and never reached critical mass. When prices did pop up a bit, they mostly just flat-lined or range traded after the tiny jump. Bitcoin started a big upward push in the early part of 2020 and then the corona crisis black swanned it like everything else. Bitcoin tanked with every other asset in world, forever putting to bed the “safe haven” narrative. If anything Bitcoin had gotten boring. Traders saw it as just another asset and dumped it along with everything else as they flooded to traditional safe havens like gold.

But in the last few months Bitcoin and Ethereum started to recover. I jumped back in. I also started reading up on the latest news. Was anything driving this new market frenzy or was it just the usual wild west at work once more?

No matter where I turned I saw DeFi, DeFi, DeFi.

But the more I looked at the DeFi craze the more I looked at it with a hard and skeptical eye. I quickly agreed with my friend, Maxine Ryan, a recovering Bitcoin entrepreneur, that DeFi was just crypto rebranded. Crypto was always about decentralized finance. It’s peer-to-peer money. What made this any different?

It was Peter that changed my mind once more. I called him up and he’d already dove deep into DeFi. He was running nodes, staking coins and arbitraging like crazy. He’d already started lending coins for interest.

It’s fitting that in his last words to me, he sent the coins he was buying and staking over messenger.

“LINK, LEND, RLC, KAVA, ATOM, REN, SXP, SNX. I stake my tezos on KuCoin, they have a good return plus give you bonus in their POL coin. My DIVI is paying me over 30% a year and it’s up 4x since I got it, already sold off more than I invested. I’m in an ICO that is paying me 30% until they are done at the end of the quarter, BIDAO. I’m staking Matic on their network.”

As always he and I disagreed on which coins mattered. I mostly just like Ethereum because it benefits the most from all these other coins. More and more I think most coins are just beta tests for tech that eventually makes its way into Ethereum.

Over time my more conservative trading strategy, mixed with a dash of risk, has proved stronger than Peter’s. He loved the action, the wild west, the win-it-all or lose-it-all approach. He made a lot more than me and lost a lot more too.

But Peter was always a pioneer and he led me to many great coins and ideas and concepts I would have missed. Because of him I looked closer at the scene and realized a lot of the things I’d talked about years ago had finally started to happen.

I’ve written many times that we needed to get the hell away from centralized exchanges. They’re nothing but centralized choke points and they mirror the old world financial systems. But during the last crypto boom DEXs had just started, tiny mustard seeds. Now they’re a real thing and doing real volume. We’re even seeing new innovation in centralized exchanges too, with ByBit and its powerful order engine blowing away the incredibly inventive but overwhelmed BitMex.

Of course, why do we even need exchanges at all? Crypto is digital money so can’t we just swap coins right on the chains with a little coding magic?

We can.

Atomic swaps, that let you swap coins wallet to wallet, are getting very real too.

It won’t be long before we have universal protocols that every new coin supports that let’s you flip money at will. At that point there won’t ever be a Mt Gox again because trading won’t require you to trust an exchange at all. You’ll hold the coins in your wallet and check out a decentralized price aggregator and swap them when ready, all without ever leaving your wallet.

Algorithmic interest and lending have gotten real now too. People earning 1% to 10% consistently is something they could never do in a money market fund. As soon as the Fed cranks up the printers, the rate of return crashes to nothing in a traditional bank account. Staking coins returns even more because stakers earn bits of transaction fees as they process the traffic on the network. Lending coins peer-to-peer looks strong too.

But for all the innovation I’m seeing, crypto still has a long way to go.

Nothing tells me that more the Peter’s death.

Before he died he gave his crypto keys to his mom and told her that if anything happens to him she should call me. Now I’ll have to dig through his desktop and wallets and phone and whatever random exchanges he was frequenting to find what he’s got out there. I’ve got days or weeks of digital detective work ahead of me and I may not find it all.

It won’t be easy.

He was never afraid to venture into the wildest and darkest corners of the web to try out some ugly and experimental exchange or coin. He lost more money to broken protocols and exchanges and DEX hacks than most people will ever make.

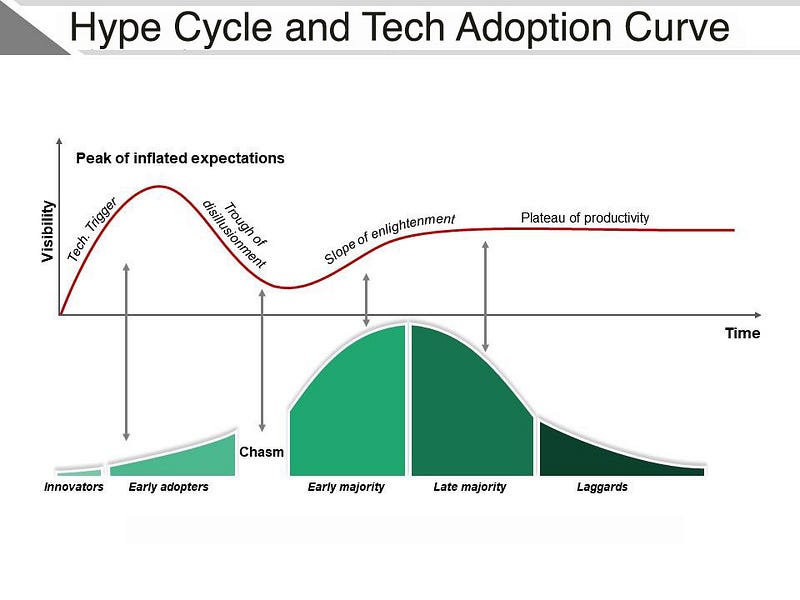

But he kept trying. He was the epitome of the super early adopter on the well known technology adoption curve.

But here’s the thing. It shouldn’t be this way.

I should have a safe and easy way to find all his coins.

We could have a non-custodial, decentralized local tracking system for all our coins and wallets that offers a second way to get them.

We should already have beautifully designed decentralized protocols that give someone universal security, like a password reset function that doesn’t need me to call some moron in a call center. If you really think about it, answering a few questions to prove you’re you is pretty easy to automate and we could make everything infinitely safer for everyone if we did it right. When you set up your keys you could answer some questions that get safely hashed to a chain or wallet that you can then answer to unlock it.

No human necessary. Just protocol.

Private keys shouldn’t die with someone when they really die.

Maybe something like Keybase is the answer so you can share your files and private keys securely with a trusted group of people. But I still feel like we don’t have a good solution here. You don’t want those people having access while you’re alive, only when you’re dead.

We need something…more.

What will that look like?

Eventually we’ll have amazing, automated protocols for dealing with all our crypto assets when we go to the great beyond. It won’t be easy but it’s doable. It will look like some kind of smart contract, mixed with a real contract and some LINK style oracle magic to prove someone is really gone.

We should have beautiful central dashboards where we can trade anywhere and load up with any coin we want. We can have that and still have amazing control. We don’t need to trust custodians or some central overseer. The very first thing I looked for was an awesome dashboard to try out DeFi and see what it had to offer. I found a lot of possibilities but very few I’d trust on closer inspection. Most of them don’t pass the most basic sniff test. Worse, most of them are still hideous and convoluted and focus on only a few coins or protocols or concepts.

But we have made some progress. Gorgeous wallets like Atomic Wallet can handle hundreds of coins and stake them for you. DexWallet promises to get you moving on all the major DeFi platforms like Maker and Compound with a fast and fluid interface but it’s only IOS at the moment. It desperately needs a desktop and Android version fast. Metamask still delivers the go-to experience for ICOs and basic blockchain interface work but it’s still not beautiful or easy to use.

Some wallets are already looking to solve the death problem. The Argent wallet looks to do away with private keys and designate trusted devices and people who can reset your access to your coins. It’s a step in the right direction but it’s still a little rough around the edges to use. And I don’t want these protocols to replace my private keys anyway.

I want my private keys and I want a universal protocol for resetting them that’s nearly impossible to hack.

We have a lot of precedence for things like that in the regular computer world, with authentication protocols that everyone can use so teams don’t need top notch security geniuses on staff just to re-invent the wheel.

Scaling and every other issue I wrote about in The Five Keys to Crypto Evolution are still a problem. Maybe Ethereum 2.0 will finally start to shift that to a real solution in the real world? As I said earlier, I increasingly think that every other coin is just beta testing cool ideas like zk-snarks and sharding that will eventually get rolled into later versions of Ethereum. The biggest and smartest investors I know hold lots of Ethereum and very little of anything else.

DeFi means progress on one of those keys, the killer app. I’ve argued forever that you can’t just mint Internet funny money and tell someone to go find a use for it. You need to give them an actual use for it now.

Peer to peer lending and algorithmic interest are a great start on building real world applications for digital, decentralized money. Algorithmic interest will increasingly sweep in early adopters and early majority investors as the corona crisis continues and the nation states of the world continue to destroy savings. When people’s bank interest suddenly drops to nearly zero as the federal money printers go brrr people might start looking for a true alternative interest that doesn’t fluctuate at the will of the Fed or ultra-nationalist leaning.

But is DeFi the killer app messiah we’re all waiting for?

Time will tell.

For now it seems we’ve still got a ways to go until everyone is borrowing and lending money on the equivalent of AirBnB for money.

But as crypto spring flowers into crypto summer, the seeds of the real revolution are finally sprouting.

In the meantime, while you’re waiting for the killer app, make sure to backup your coins and have a plan for when you die, so your coins don’t die with you.

############################################

If you love my work please visit my Patreon page because that’s where I share special insights with all my fans.

Top Patrons get EXCLUSIVE ACCESS to so many things:

Early links to every article, podcast and private talk. You read it and hear first before anyone else!

A monthly virtual meet up and Q&A with me. Ask me anything and I’ll answer.

I also share everything I’m working on and give you a behind the scenes look at my process.

Access to the legendary Coin Sheets Discord where you’ll find:

Market calls from me and other pro technical analysis masters.

The Coin’bassaders only private chat.

Behind the scenes look at how I and other pros interpret the market.

###########################################

If you’re passionate about artificial intelligence then come join the communities were we talk about how to build the AI stack of the future and how to make AI work for everyone.

Practical AI Ethics Foundation

############################################

I’ve got a new podcast, The Daily PostHuman, covering crypto, AI, tech, the future, history, society and more! Check it out for expanded coverage of my most famous articles and ideas. Get on the RSS feed and never miss an episode and stay tuned for some very special guests in the next few months!

############################################