What’s the perfect crypto killer app?

Lots of projects think they’ve got it nailed down but let’s face it:

Crypto’s killer app is still missing in action.

I’ve talked about killer apps a few times but today I’m taking it one step further. I’m going to give away a multi-million dollar business idea for free.

We’re going to walk through how you can take on big, popular business and kill them off with a crypto version that makes it utterly impossible for them to compete with you.

And you can have it up and running in six months.

Why the hell would I give that away?

Because that’s what I do.

I’ve taken open source to the business and idea level. I wake up with a new business idea every day but I don’t have the time or desire to do them all so I’m just throwing them out into the universe. I’d rather fifty teams start working on this tomorrow than one team. Competition makes the market grow stronger, faster.

So take it, run with it and retire early.

And if you get it off the ground and feel like sending me a bunch of tokens as a thank you I won’t stop you but either way I’m good.

All right. Ready? Let’s go.

What about Bitcoin?

Wait a minute here though. Isn’t Bitcoin the killer app already?

Some folks say that and they’re not wrong. It’s money uncontrolled by any central authority and it’s managed to survive and thrive in a hostile and chaotic environment.

But who wants to stop there?

That’s like saying we discovered fire so we’ll just call it a day.

Hey guys, we got this light bulb thing figured out but there’s absolutely nothing else we can do with electricity.

We’ve thought of everything. We’re done.

No.

We haven’t even come close to thinking of everything in crypto. We’re not close to done.

Sure there are snarky articles from doubters who say blockchain will never do a damn thing but that’s pretty short sighted. For a long time AI was considered nonsense. For decades it crashed and burned. Neural networks couldn’t win at tic tack toe, much less the insanely complicated game of Go and they certainly weren’t driving cars.

Where are those naysayers now? Confined to the dustbin of history like every other Luddite who ever lived.

History is clear. If you bet against technology it’s a losing bet.

In fact, I challenge anyone to point to a big technology that’s actually failed in the past. And don’t cheap out here. Don’t point out a single product like Virtual Boy or iteration of a technology that failed but an entire category of technology that failed.

What do I mean by that?

Game consoles are a technology category. Atari 2600 and Sony Playstation are iterations. Home video recording is a category. Betamax, VHS, DVD and DVR are iterations of that tech.

Categories matter. Iterations are just dust in the wind.

It’s super easy to find iterations of tech that failed. Dams burst. Bridges collapse. AT&T’s lines go dead. The Concorde crashes. But the platonic form of dams, bridges, phone lines and airplanes endure. And eventually someone gets the iteration right.

Lots of people tried to sell stuff online before Amazon got it right with books. VR failed for years until Oculus Rift.

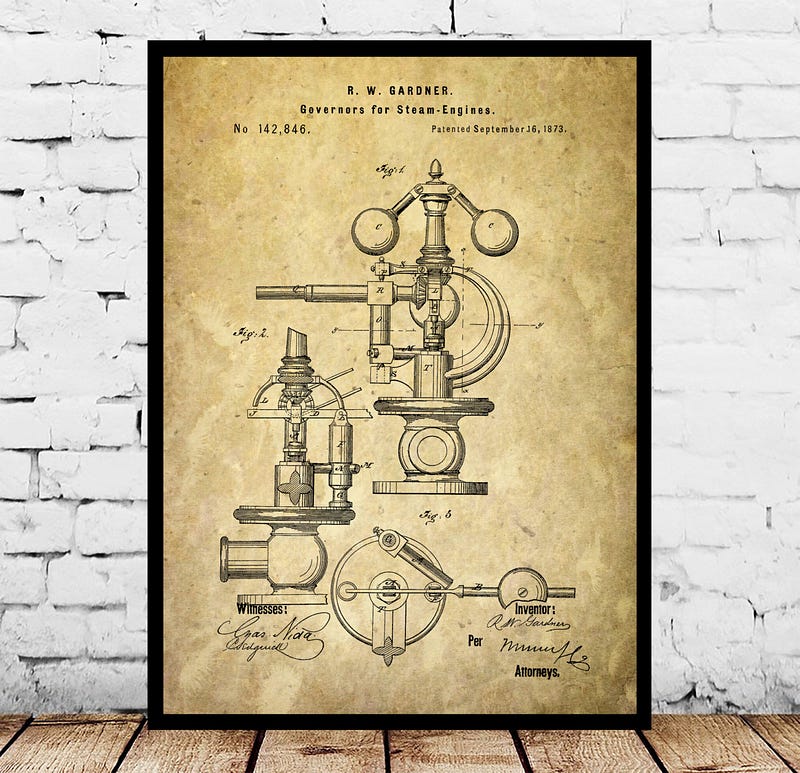

The steam engine took a century of trial and error.

The first working steam pump, patented by Thomas Savery, tended to explode. Savery came up with his spin on the tech in 1698. It took another seventy years before the technology really took off with James Watt’s revolutionary design in 1765 that doubled the energy efficiency of an earlier design by James Newcomen in 1712.

And it still took eleven more years to make it to the market even after that breakthrough.

For everyone saying that crypto already had more than enough time to innovate remember we’re only eight years into this thing. Real innovation takes decades of setbacks and failures, even as the pace of human development continues to accelerate faster and faster.

We’ve gotten so caught up in having a new gadget or breakthrough every few minutes that we sometimes miss the unseen backstory that got us there.

For every breakthrough there were a million lonely hours and a million failures.

We’ve grown incredibly impatient and unrealistic, expecting miracles too soon. Technology starts off slow and steady and then explodes upwards in a wave of growth. That is the exponential curve but it’s never as fast as people think. Take this example from the brilliant article The Psychology of Money:

“IBM made a 3.5 megabyte hard drive in the 1950s. By the 1960s things were moving into a few dozen megabytes. By the 1970s, IBM’s Winchester drive held 70 megabytes. Then drives got exponentially smaller in size with more storage. A typical PC in the early 1990s held 200–500 megabytes.

And then … wham. Things exploded.

1999 — Apple’s iMac comes with a 6 gigabyte hard drive.

2003–120 gigs on the Power Mac.

2006–250 gigs on the new iMac.

2011 — first 4 terabyte hard drive.

2017–60 terabyte hard drives.

Now put it together. From 1950 to 1990 we gained 296 megabytes. From 1990 through today we gained 60 million megabytes.”

Crypto has a long way to go. It will get there but we have to have patience and perseverance.

But that doesn’t mean we have to wait for crypto to revolutionize everything to build some killer apps right now.

The more I think about this thing the more I think we’re missing some seriously obvious low hanging fruit:

Crypto Kickstarter.

So let’s get rolling.

Step One: Stop Trying to Change the World

Today we reward crypto projects for thinking big and audaciously.

Projects like Ethereum, EOS, NEO, IOTA and Radix are out there trying to reinvent everything from payment processing, to identity, to DNS, to storage, and messaging. Without a doubt this is the way crypto really takes off running over the long haul. Comprehensive decentralized platforms that do everything and the kitchen sink will change the way we live, work and play in the next decade and beyond.

But what if the path to the first killer app was a hell of a lot more simple?

The problem with all these platforms is they’re trying to reinvent the wheel. Sure there are a million things broken about the current web, from big company dominance, to endless bugs and security vulnerabilities, to a complete lack of privacy.

But sometimes the wheel doesn’t need reinventing. It’s good enough.

To build a profitable business you don’t need to build the end all, be all platform that rockets to world domination, while simultaneously coming up with a new business model and a never before seen application.

You just need to build a slightly better mouse trap.

Kickstarter is already a kickass mousetrap so we’re going to model its strengths and weaknesses and we’re going to build on its strengths and attack its weaknesses.

Many of the most successful businesses in the world are not revolutionary, they’re just fresh takes on old and established business models. Figure out how to take out the trash better or buy books better or fold laundry better and you could have a big winner on your hands.

Take Uber. It made getting a taxi much easier. It may seem like Uber made a ton of massive changes to how we order a ride but not really.

It made three big changes:

1) It created a rating system so you could get into a car with a stranger and not feel like you were going to get knifed by a madman. Sometimes bad things still happened but we miss the fact that it happened with cabs too and it happened more often no matter what the scary news man tells you about big, bad, evil Uber.

2) It made ride sharing peer to peer, which broke the model of centralized companies that owned all the cars, which consequently saddled those companies with a fantastic amount of debt, risk and initial capital exposure. That left them with little money to innovate because they had to drop so much cash just to buy all the cars in the first place. As soon as Uber made it bring-your-own-ride (BYOR) they were doomed.

3) Lastly it automated the routing of cars. A taxi dispatcher once did that gig, sending out cars as fast as she could but it didn’t scale well and even the best cab companies were prone to constant routing errors like cabs not showing up on time or at all. The computer did that work better and faster and it showed you where the car was at all times!

That’s it. That’s how it’s done.

Figure out the problems and create a real solution to those problems and you have a winning business.

Simple right?

Well not so much because you need to have a killer insight into how another business works, how it fails and how you can fix it.

But it can be done. Let’s look at how.

Step Two: Use What Works

Now we know we’re building a Crypto Kickstarter. So how do we build it?

We start by using what already works well.

If you’re out there trying to remake HTTP and streaming video you’re up against a mountain so high you might never climb it. It’s not that the web can’t do with some serious improvement. So much of the web has turned into a dystopian nightmare of horribly broken security models and zero day exploits. But fixing that legacy is not easy.

If it were easy we would have done it already.

The web might be the very best we can do with some of these things for now.

Millions of man hours, billions of lines of code and tens of thousands of companies and projects made the web what it is today and when you want to rewrite all of it you’re starting from scratch.

That’s not just a big mountain to climb, that’s Mount Everest squared.

So why try to climb the mountain at all?

Forget waiting for Ethereum or EOS to change the nature and cost of distributed storage. Amazon already has cheap storage. Don’t wait for someone to reinvent HTML. Web design is an established science and so are web servers. There are some downsides, sure, but we already know how to build a massive, scalable, distributed web cluster running on a public cloud with Docker containers and Kubernetes.

Leave reinventing the wheel to the super ambitious projects. You just need a kickass website and you’re going to layer your superior payment system over the top of that working infrastructure.

Step Three: Fingerprinting Your Target

To take out an existing business we need to study that business inside and out. So let’s get to know our target a little.

Kickstarter has a simple business model. They raise money via crowdsourcing. A creator puts up a concept, does all the advertising and promotion and people join the platform and give them money. For their donation they get a few trinkets like a sticker or poster or early access to the product if it ever comes out.

Kickstarter snags 5% of the total take and the payment processor take 3% + 20 cents on every pledge.

Unlike ICOs they got an exception from the SEC for small, non accredited investors. That means that if you’re broke as a joke you can still donate money to the next board game on the crowdfunding Goliath with no problem. ICOs should take note of that exception because crowdsourcing done right does not draw the ire of the central powers and even gets them to rewrite the rules for your specific business.

Kickstarter publishes stats on how many projects get funded to entice creators to roll the dice and launch their own campaign but that appears to be all time stats, not yearly.

Other sites use that data to dig into their business. Because the company is not public we can’t check out documents filed with the SEC. That makes it harder to know just how much cash they are burning but we can figure out a few things easily.

According to ICO partners, Kickstarter saw $601,102,946 in successful pledges to projects in 2017. Since they take 5% of that money they have raw earnings of $30 million dollars.

Unfortunately we don’t know how much they’re spending to earn all the money. They could barely be breaking even for all we know.

If you’re really going to try to build this business you’d have to scour the web and dig deep to find out as much as you can about their expenses so you can figure out their net earnings per year.

For the sake of simplicity we’re going to guess here just to have a target for our own business and for the article. Let’s pretend we buckled down and did the hard work and we found out they’re spending $20 million dollars per year on salaries, supplies, data centers and all the other things it takes to keep the lights on in a modern business.

That leaves us with $10 million in net profits. We’ll leave taxes off the table here, again for the sake of simplicity, though that should absolutely figure into any analysis you do of any target competitor.

Now that we know a bit about our business we’re going to find out its weak points.

Step Four: Find the Weak Spot

Any existing successful business is a patchwork of pluses and minuses.

Maybe they’re kick ass at making software but their ordering process is a total mess behind the scenes. Maybe it’s a restaurant chain that knows how to make a mouthwatering sandwich but can’t squeeze any more cost savings out of their supply chain or they can’t make those delicious sandwiches any faster without hacking the universe and speeding up time.

Any business is subject to the limitations of its era.

They’re just doing the best they can with the tools they got. There are problems they literally can’t solve with current technology or the best and smartest ideas of their time. So they make do. They find a way to paper over that weakness, making it as efficient as possible but eventually hitting a very real bottleneck that they can’t get beyond.

And for awhile it doesn’t matter.

Until it does.

When a new technology comes around it changes the game. It changes the very nature of what’s possible in reality. It opens up avenues never before imagined.

We already said that crypto has a long way to go but it already has some built in advantages that traditional businesses can’t compete with if they’re still shackled to fiat money. That’s our cutting edge.

So what does crypto already do that traditional businesses can’t?

One of the first and most obvious is that it lowers fees.

Traditional payment providers charge 2.9% + 30 cents for every single transaction. And you’ll see later that 2.9% is really a con. It’s closer to 4.5% or 5%. We’ll run the numbers and take a closer look to see just why.

Kickstarter lists payment processor fees at 3% + .20 cents per pledge, though it outright says the payments can fluctuate as high as 5%.

It may not seem like it but that’s a lot of money lost over time to middlemen. It adds up fast.

In contrast, the average Bitcoin fee stood at .4825% on the day that I looked at it. The average Bitcoin Cash fee rolled in at around 0.0982%. Ethereum came in at 0.0991%. And that’s just a fraction of the coins out there. Some of them have dramatically lower fees and make it a focus to keep those fees super low.

Of course these fees can and do fluctuate, but since there are lots of cryptos we can give the donation sender a choice to pick the one with the lowest fees. We can also have our app set the fees we’re willing to pay, keeping it steady even as the whole network fluctuates.

We also have a strong advantage with our business model: It doesn’t matter if our payments take a little bit to get there. We’re not buying coffee here. If you’re buying a coffee you want it right away but the vendor would need to wait for the network to clear the transaction, maybe ten minutes or even much longer if we’re talking Bitcoin.

But the money in Kickstarter gets escrowed until the creator hits a certain threshold before it’s released to the creator. It doesn’t matter if it takes ten minutes or ten hours to get the payment through the crypto network because the escrow hides that from the end user. We can just credit a successful pledge and go back to them later if it doesn’t clear for a set amount of time.

That means your first advantage is cutting out the cost of those middlemen which means more money goes to the creator and your business instead of the payment gateway.

Even better, Kickstarter cannot make that fee go any lower because they’re totally and completely dependent on the payment provider. Those are the fees and they can’t just spin up a new Visa or Paypal to compete.

They’re shackled to a legacy business model and your lower fees are an automatic advantage that will slowly starve a traditional business to death.

Now imagine a Crypto Kickstarter.

We already have them beat on the 3% + 20 cents. We have them beat by 2.5% on average. 2.5% might not seem like a lot but that’s another $5,000 on $200,000 raise and it just keeps going up the higher you get.

Actually it’s worse than that. The 3% is a shell game to make the fees appear lower than the actually are while taking more of your money.

As always math is our friend so let’s do the math.

When someone donates $10 on Kickstarter, the payment processor snags 30 cents (3%) plus another 20 cents on top of that 3% which brings the total transaction fee to 50 cents and that makes it a whopping 5%.

Now let’s keep it simple and imagine all the donations are $10.

That means on $200,000 raise the creator loses $10,000.

Oh and that’s before they pay Kickstarter their 5% fee. Kickstarter takes that out of what’s left of what you already lost. On your $200,000 raise you lose 10K, leaving you $190,000. Kickstarter grabs $9500 and you’re left with $180,500.

You lost almost 10% in fees.

Ouch.

Now let’s punch Kickstarter in the mouth and cut their fees where it hurts most.

We’ll charge 4.5% instead of 5%.

It looks like we’re making a lot less money, with basically the same costs to run a big, huge website and infrastructure but actually we’re not loosing all that much and we gain something in the process. Because more of each donation is going to the creator we pull from a bigger pool.

Let’s run the math again this time with crypto using the average Bitcoin fee of 0.4825%.

That’s $960 gone to transaction fees on $200,000 raise, which leaves the creator with $199,040. Now Crypto Kickstarter takes its 4.5% off the top, snagging $8956 in fees and that leaves the creator with $190,083.

We pull in slightly less than Kickstarter but it’s giving us the added advantage of making it super painful for them to compete. They now have to carve out 5% from their razor thin bottom line and there is nowhere to cut. They’re cutting bone.

Now let’s reverse course and make it even worse.

After we get traction, we raise prices.

We charge 6% and still come in less for the creator. We grab $11,942 and the creator still makes more on our platform, a critical advantage.

To compete Kickstarter would need to drop their fees as more and more folks fled the platform to their crypto rival, slicing deeper into their bottom line.

But it doesn’t stop there. Now we’re out for blood.

Step Five: Bring the Pain

Let’s go for the jugular here.

We’ve already hammered Kickstarter’s business model with brutal efficiency by taking established cryptos like Bitcoin, Dash and Ethereum and ditching filthy fiat blood money.

Now let’s launch our own rewards based crypto using my theory of gamified money and kill them off once and for all.

That’s where we take the concepts pioneered by video game designers and bring them screaming into the real world. Rewards and punishments drive the system and drive the behavior of the people using it.

Push/pull. Carrot and stick.

First we make a comprehensive list of all the behaviors that benefit the system, like referrals and big donations.

Be careful. This is not easy. It just sounds easy. You need a comprehensive understanding of economics, game theory, probability, psychology and more.

You have to see clearly and understand the entire micro economic system you’re building, all the behaviors of all the actors, good and bad. You have to imagine how to grow step, by step, by step.

And you have to figure out how to destroy it so you can protect it too.

This is about encouraging what we want and discouraging what we don’t want. So take your time and really think it through.

For sure we want more people to join our platform, so we offer a reward to people who refer people into the network. But we don’t want people cheating the system and signing up a bunch of sock puppet addresses so we make sure that only people who come in and spend money get counted. Our smart contracts escrow the rewards for a time and releases them as people add to the power of our platform.

We also want more creators so when new creators go through the process of setting up their very first project and getting initial donations we hit them with some reward coin.

We want more people to give and we want them to give big. That means big donors get big rewards too.

Big creators make us the most money, so the biggest projects get a bonus in our token.

Projects that hit milestones like the first donation, the first 25%, 50% and 75% get rewards but we escrow those rewards until they get funded and hit all their milestones or we’ll have folks gaming the system, getting the rewards and then just pulling the project before it finishes.

That brings up an important point. For every reward we have to imagine all the ways to attack it so we can design anti-cheat rules, again just like a video game.

This goes on and on, a layered series of smart contracts that keep the network moving for us, pushing and pulling everyone along.

Of course, the reason this is an absolute killer is because Kickstarter simply cannot do this with fiat money. They’d need to go buy a bunch of fiat, only to give it away, further smashing their thinner and thinner bottom line.

But with crypto we’re literally printing the money out of thin air. We don’t need to buy it. We print it.

And if people find it valuable then it becomes valuable.

Nothing has any value but the value we give it. We all believe the dollar has value so it does. Simple as that. And why would anyone think our crypto is valuable?

Because our crypto Kickstarter is taking the world by storm.

Oh it doesn’t start out that way, of course. But let’s visualize the entire story of the little crypto engine that could.

From Idea to Reality

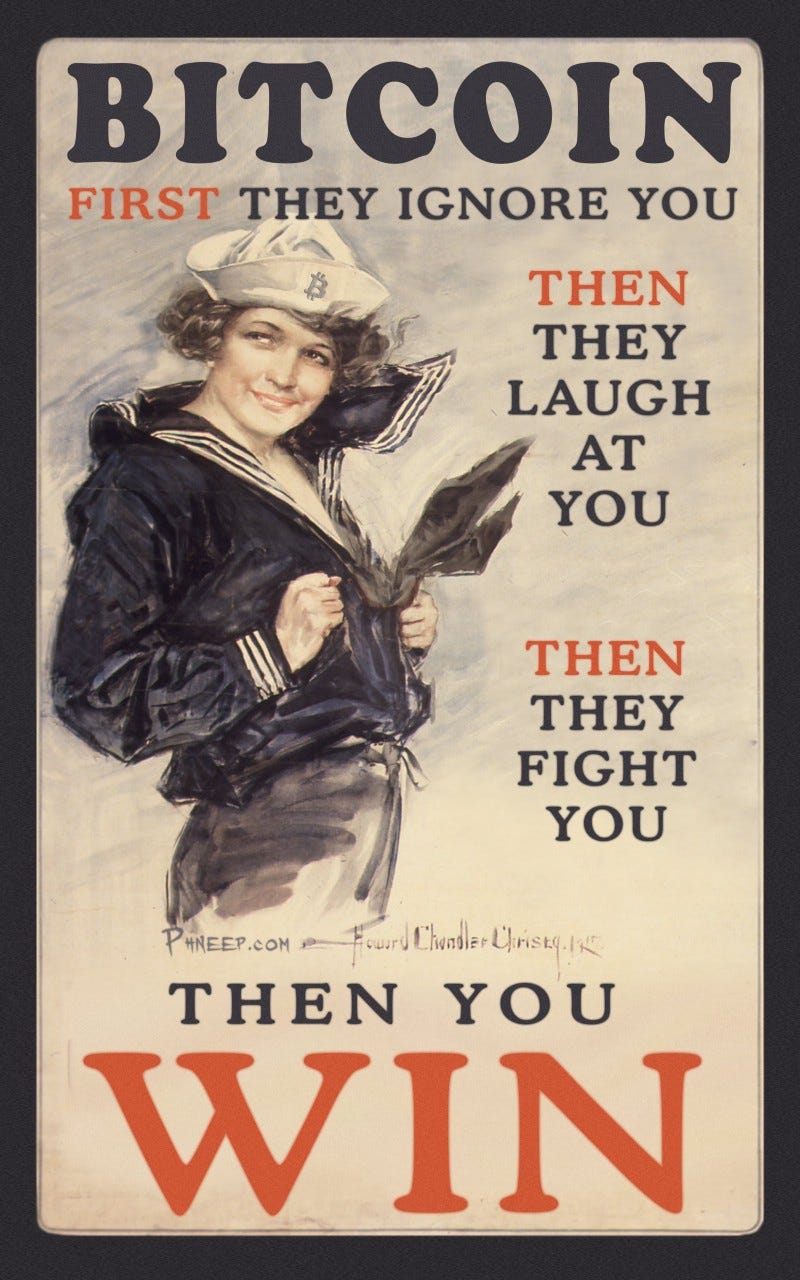

At first Kickstarter laughs at our little company.

Who the hell are we to take on the juggernaut? Others have copied the model and failed or just become second rate crowdsource platforms. We’re copycats, nobodies.

Second we’re using crypto and it’s not even on their radar.

“Crypto? What a joke?” say their smug executives in their ivory towers. “Nothing but Internet nerd money. It’s only for criminals and drug dealers. No one will take that place seriously.”

They go right on sipping the good gourmet coffee from the fancy pants coffee place as they look at next years projections with nothing but blue sky ahead.

But we’re not copying their model. We’re improving on it.

At first our site isn’t perfect. It’s a little uglier and quirkier than Kickstarter. But our developers keep hammering on it, improving it, using well established DevOps models. Then one day it’s good enough.

That’s when people start to look at it and consider it.

Maybe an influencer gets rejected from Kickstarter because they don’t like what he’s putting together so he comes over to our platform. Pretty soon others are following, drawn by his positive tweets about the site’s streamlined interface and growing ease of use.

In no time, it’s gaining new followers every day. It starts to make the news, a few initial scoops at first, nothing much, but nothing to sneeze at either.

Then the big breakthrough comes.

A veteran Kickstarter creator gets sick of the high fees and comes over to our platform with his new killer product and rakes in $300,000 in Bitcoin in a few weeks.

Now the news is all over it.

The veteran raves about how much more of the money he kept on the new platform. Sure there were some hiccups but the support team was super helpful the whole way, not like that other platform where he was just a drop in a bigger ocean. He loves it.

Now other people want in. It goes viral on Twitter and Facebook and Reddit.

And unlike Kickstarter people signing up get something for joining other than a t-shirt or a sticker from some project. They get a real universal reward coin and suddenly the system catches on like wildfire and Kickstarter is scrambling.

Now it’s not a joke. It’s a threat.

Kickstarter attacks, maybe with patents and lawyers, and they try to get some of what we’ve got cooking but we beat them back and the judge throws out their pointless suits as our VCs double down on the growing business.

Now Kickstarter is in real trouble. They threw a haymaker and missed. People get fired.

Hard questions get asked. Why didn’t we see this coming? How did we miss this?

“Who’s in charge of our blockchain?” screams a desperate exec with three kids and big mortgage who’s now staring down the barrel of layoffs.

“Nobody,” comes the answer from IT. “You said it was a joke. Just for criminals and scumbags. You told us to kill the project and fire all the crypto developers.”

And then the scope of their colossal mistake hits them as they start to run the numbers.

There is nowhere to cut. Crypto Kickstarter is charging more than them and they still have a better bottom line.

So they start cutting essential payroll, the little people from the already strained support staff and the fresh young engineers just out of college and eager to help.

Now they’re in a death spiral.

They’re bleeding talent. The word on the street is “layoffs” and they’re radioactive.

They have more outages because there’s no one to keep the lights on. IT is overworked, everyone doing two or three jobs each so they start to quit and it gets worse, a vicious cycle.

People start to complain about how bad support has gotten. They post about it on Twitter and Facebook. The rant about it on YouTube.

Every day it gets worse and worse.

Finally, a Kickstarter bigwig tries to pivot on a dime and develop their own crypto but it’s not their specialty. They don’t know what they’re doing. They’re used to control and things are out of control. They don’t want open source money, so they buy some proprietary crapchain from a big firm, hoping they can compete but it’s garbage because they don’t understand that nobody good in this space works for those guys.

Their crypto fails miserably because there is no secondary market and nobody wants it. It’s like getting pennies thrown at you. Their money is worthless.

And that is the death rattle. They can hear the Reaper coming for them and everything they’ve ever built.

They’ve blown their last and final advantage, their war chest from previous good years.

Even worse, they’ve blown it on a broken solution. Now there’s no way out. No exit.

And just like that, they’re gone.

The Neverending Cycle

It doesn’t take much.

Businesses die all the time.

A new rival comes out of nowhere with a brilliant take on the old model and suddenly it’s too late. The old dinosaur is outflanked and outgunned. They’re filled with middle managers who wouldn’t know a good idea if it punched them in the face.

They think their business model is a moat that nobody can cross but it’s an illusion. Few companies have a true moat and even the widest mote doesn’t last forever.

Just when they need to be most agile they’re stuck in the sinkhole of their own fear and doubt.

Crypto will creep up on businesses like this and they won’t see it coming. It’s going to catch many, many people off guard, asleep at their post.

And then one day they’ll wake up and the only way they can start a new company is by taking crypto very, very seriously.

Suddenly all the developers are in super high demand. You can’t hire the best people if you want to because your rival already did.

That’s how the cycle of birth and death goes in the business world and in life.

You can’t fight the future.

You either embrace it or you die.

############################################

If you love my work please visit my Patreon page because without it this blog simply wouldn’t exist.

Top Patrons get EXCLUSIVE ACCESS to so many things:

Early links to every article, podcast and private talk. You read it and hear first before anyone else!

A monthly virtual meet up and Q&A with me. Ask me anything and I’ll answer. I also share everything I’m working on and give you a behind the scenes look at my process.

Access to the legendary Coin Sheets Discord where you’ll find:

Market calls from me and other pro technical analysis masters.

The Coin’bassaders only private chat.

The private Turtle Beach channel, where coders share various versions of the Crypto Turtle Trader strategy and other signals and trading software.

Behind the scenes look at how I and other pros interpret the market.

###########################################

Come check out the podcast about this article on my new show, The Daily PostHuman, covering crypto, AI, tech, the future, history, society and more!

###########################################

Sometimes folks want me to help design their systems or advise their projects. I rarely do it but a few amazing projects have caught my eye from time to time.

If you want to interest me make sure it’s world changing tech and that you have a real budget [aka not just your tokens], a plan and a reasonable timeline. Ping me at cicada [AT] iamcicada.com. No attachments. Attachments go right into the trash.

If I don’t answer it’s because my schedule is already full.

Please don’t take it personally.

I am an author first and foremost. Projects and advise are not my focus.

############################################

People often ask if I will do a promotional article for them on this blog. The answer is absolutely not. Not for any price. If I write about you it’s because I want to write about you. This blog is not for sale.

###########################################

A bit about me: I’m an author, engineer and serial entrepreneur. During the last two decades, I’ve covered a broad range of tech from Linux to virtualization and containers.