How to Crush the Crypto Market, Quit Your Job, Move to Paradise and Do Whatever You Want the Rest…

Do you like making money at the push of a button?

Do you like making money at the push of a button?

How about working from home in your underwear? Do you hate corporate meetings worse than the plague? Would you rather be traveling the world, having adventures and sleeping on a beach in Thailand than grinding your life away in an office for fifty years?

Then you might just be a trader, my friend.

But what kind of trader are you?

Are you looking to make steady, slow, conservative profits, year after year and protect yourself from big risks? Or are you looking to hit the home run trade, knock it out of the park and retire early to travel the world eating fine food and hiking in the rain forest?

Of course, there’s no shame in going conservative. It’s a lot easier. Just buy and hold some assets. If that’s your game, stick to my easy button strategy, Mastering Shitcoins, the Poor Man’s Guide to Getting Crypto Rich. In my opinion, that’s the best way for someone who has a life and obligations and a family and who can’t afford to stay welded to their computer screen all day. It’s a simple plan and one I employ with part of my portfolio.

But there’s another kind of trading strategy too. It holds the potential to deliver the kind of massive returns that most people can only dream about in their wildest fantasies.

Momentum trading.

This is where you’re looking to hitch a ride on a rocket and crush the market. You don’t just want slow and steady results, you want a grand slam and you want it fast. I’m not talking 20% returns. I’m talking 1000% or 2000% or 20,000% returns.

Impossible? Stupid to even try? Crazy?

Maybe.

The real question is, can it actually be done?

Turns out it can.

How do I know? Because I’ve gone out and found the traders who’ve done it.

I’ve sat at their feet and soaked up their wisdom. I’ve listened and learned. I’ve made money and lost money so you don’t have to make all the mistakes. My Padawan training is complete.

Now I’m ready to show you what I’ve learned from these legendary masters. In this brand new series of articles, The Ultimate Guide to Crushing the Crypto Markets, I’m going to share all of their best strategies and secrets.

Some of these folks have paid trading dojos and private groups and training materials.

I’m giving you everything I’ve learned for free.

Why would anyone do that?

Because it’s what I’m wired to do. I’m an author, a teacher and an open source idea factory.

Knowledge wants to be free.

And one of the best ways to find the wisdom of the ages is to study with the best of the best.

Studying the best in the world is a time honored strategy going back to Dale Carnegie and Napoleon Hill and other self help masters. But if I’m being honest, I’ve never really been a fan of self-help gurus. They always seem long on motivational pep talks and short on actual technique.

I want practical trading techniques, not a lot of fluff.

That’s what I got.

So let’s leap right in and learn how to lay siege to the market and storm the citadel of the 1%.

(Psst. If you’re really impatient you can skip to the end of the article and see the charts of actual cryptos on the move. Actually if you’re impatient, stop reading right now because the market is designed to steal money from impatient people.)

Let’s roll!

The Hidden Masters

First off though you’re probably wondering who are these people?

My criteria was simple. I wanted to meet traders who started with between $1,000 and $45,000 and turned it into millions of dollars in under two years.

The second criteria was that they actually did it. Like Tim Ferris said in 4 Hour Work Week, no pretenders allowed.

And I didn’t want people who just bought and held in the biggest parabolic boom in history. I wanted traders, people who made more than buy and holders.

Yes, that is possible.

Still you probably don’t believe these people exist or that it is possible.

It’s ridiculous right? Nobody can beat the market.

And yet I’ve studied with five different traders who’ve done just that, believe it or not.

Actually I don’t ask you to believe anything because belief is the death of intelligence. All you need to do is look, listen with an open mind, learn and then decide for yourself. Every single one of these people, four guys and one gal, stressed the need to transcend your limiting belief systems and believe it can be done before you do anything else.

Jordan Belfort, the Wolf of Wall Street, said “The only thing standing between you and your goal is the bullshit story you keep telling yourself as to why you can’t achieve it.”

That’s just the thing. Most people don’t believe it’s possible or they think the people who did it got lucky.

If you believe that you can or you can’t, you’re right. I used to think that was some hippy dippy crap, but it turns out it’s literally true. If you don’t think it’s possible you can’t even get off your ass and get started.

But this is not going to be some power of positive thinking new age nonsense puff piece. Positive thinking only gets you to the starting line. You can visualize a million dollars and a Lamborghini all you want but that’s not going to get you there. Only hard work, discipline and study will. Making mistakes and learning from them will.

But first you have to think it’s possible.

And yet even after reading that I’ve met and worked with five people who’ve done this, most people will write it off as impossible. To do that they have to actively deny evidence to fit what they already believe. That’s how belief systems work. We’re wired to think we’re right even when we’re wrong. It’s crazy but it’s true.

If I walk into a room of people and ask them who’s a better than average driver, 90% of them will raise their hand. The other 10% won’t raise their hand because they know I’m asking a trick question but secretly they believe it too. Everybody does.

Since it’s impossible for everyone to be better than average there’s only one conclusion we can come to here.

Most people are lying to themselves and to the world.

There’s reality and there’s what you think about the world. Usually they’re not the same thing. When your beliefs meet reality, reality wins every time if they’re not in sync.

You might think you can eat whatever crap you want and never work out but after eating burgers and fries for forty years you will learn your last and hardest lesson.

So that’s step one from every single one of these legendary traders.

Get your mind right.

Learn to see yourself truthfully.

If you can’t do that, you won’t get anywhere. It’s like those old long division problems you hated in school where you got step one wrong and the other fifteen steps were wrong automatically.

You can’t start from the wrong premise and hope to come to the right conclusion.

How do you learn to see yourself more clearly?

Ask questions.

What are you good at? What do you suck at? When you fail, why did you fail? Be relentless in answering these questions. Did you over trade? Were you in a bad state of mind? Were you trading drunk? Did you use too much leverage? Were you seeing phantom patterns that don’t exist? Do the patterns even work at all? If so which ones do and which ones don’t?

Why do you just automatically assume that because you saw a bull flag on Twitter or in the bible of technical analysis it’s true? Maybe bull flags are crap? Ever think of that? Who told you they were true? Accept nothing at face value until you test it for yourself. If a pattern continually fails you, assume it’s wrong and move on until proven otherwise. Be flexible. Be adaptable.

If you want to get good at anything you have to learn to see your strengths and weaknesses accurately.

If you don’t start with the truth you can’t possibly get anything else right.

First the truth, then everything else.

Teach a Man to Fish

Step two that every single one of these traders emphasized is that you have to learn this yourself.

If you’re out there looking for a signals group so you can buy like a robot, you’ve already failed. You can join a group if you like but only if that group is there to teach you to fish not keep you dependent on the group.

What do I mean by that?

Give a man a fish and he eats for a day. Then he promptly starves to death waiting for the next free fish. Teach a man to fish and he eats for a lifetime.

You want to become the master yourself not sit at the feet of masters your whole life picking up their scraps.

This is an active process. You have to get in there and learn by doing.

You have to lose money, make money, lose it again. You have to ride the insane emotional waves as you win big and then lose it all. You have to think you’re a God one day and the market is your personal ATM only to get taken out to the woodshed and beaten with a rubber hose. That’s how this works. Nobody can teach you everything you need to know. You have to do it!

But that doesn’t mean we can’t learn the basics right here, right now. Even if we can’t fully understand or appreciate or believe them yet, we can get them into our minds where they can take root and start to grow and flourish.

Sometimes we’re not ready to understand something yet. They say the fool hears the truth a million times and never gets it but the wise man only needs to hear it a hundred thousand times before he gets it. Nobody gets it the first time or the second or the fiftieth.

But the key principles sit dormant in our unconscious and suddenly come back to us somewhere down the road when we’re ready for them.

We’re ready for them when we’ve done the work ourselves. Do the work!

Then one day you’ll say ah! That’s what he meant! I get it now.

Lastly, it’s worth noting that not all of these folks are exclusively crypto traders. In fact, most of them trade all kinds of markets.

But every one of them will tell you that the best trading systems work across markets.

Trading small cap stocks on the Nasdaq or commodities like gold and oil is the same as trading Bitcoin and Litecoin. They just move at different speeds, have varying liquidity and efficiency and some of the ways to value the fundamentals very wildly.

The markets change their external manifestations but human psychology never changes and the markets are driven by very human hopes and dreams and fears.

Now that we’ve started to get our minds right, let’s get to the good stuff, the stuff you’ve all been waiting for since line one: the killer trading strategy.

Crushing the Parabolic Swing Trade

This lesson was one of my favorites and it’s dramatically changed my trading.

In all markets, in all times, there is one trade to rule them all.

The parabolic swing trade.

That’s when a small, virtually unknown stock or cryptocoin takes off on a wild ride to glory. It goes up 10X or 20X or more. It starts at 20 cents or $5 and climbs to $30 or $40 or $50. In crypto it gets even crazier. A coin that was trading at $1 a few years ago might now be trading at $100s or $1000s of dollars. The crypto market is unlike any other in terms of how far and how fast it moves. But again, the principals are the very same.

I’m not going to lie. This strategy can and does result in financial ruin for most traders. High risk. High reward.

When government officials say Bitcoin is “highly speculative” through gritted teeth, they don’t mean that as a compliment. They mean to strike fear into the heart of traders everywhere. Stay away. Don’t touch. Danger!

But highly speculative is where the big money is, no question about it.

Every trader who has ever cashed in big on the markets was a gun slinging speculator. While the sheep of the tribe think that’s a bad thing, it’s the early risk takers who grow markets when nobody else is willing to touch them. Speculators make the market boom, so that it reaches an equilibrium and serves the masses later. That’s how it works and that’s how it’s always worked.

For every ten thousand people who turn back when they see the warning sign at the mouth of the dark forest, there’s an Indiana Jones who straps on his whip and his leather jacket and strikes out into the unknown. He’s looking for the big score, the ultimate trade. He’s hunting buried treasure!

But the promise of glory also brings the promise of crushing defeat.

This is a death defying trade. It makes and breaks great fortunes. It’s a massive mountain that rises into the stratosphere and it’s littered with the bones of broken traders.

So how do you catch this crazy, wild trade?

First off you have to know a little secret.

Every market and asset is a bubble at some point.

Every stock, bond, coin, commodity or market goes through boom to bust, over and over and over.

It’s just a question of how fast it happens.

Most people don’t see it because it happens every ten or fifteen years in mature markets. In less liquid and early stage markets like cryptocurrency it happens much faster.

But it happens.

Every. Single. Time.

You don’t know how or when it will happen but it will happen, no matter what the market or the year. The markets in the 1800s are no different from the markets now. The gold market is the same as the stock market and the bond market. The markets before, during and after the dot com bubble are the exact same. They just move faster or slower.

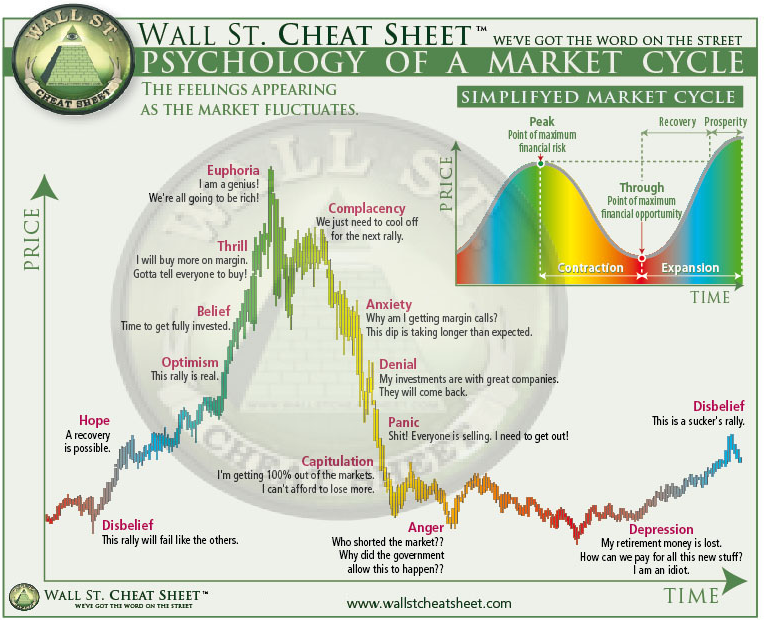

The key to breaking through in your trading is to understand the market cycle.

You also have to understand that the market cycle is a large fractal of each individual asset which goes through this very same cycle at different times. Sure there are the big market movements, boom to bust, but nobody can time those really. Trying to beat The Market, with a capital M, is a fool’s game. The bust will come when it comes.

But you can capture the cycle of individual assets consistently. That’s what these master traders do.

Now you’ve probably seen the cycle before, usually as a warning to stay away or posted by people laughing at bubbles. Like all simple truths, you ignored it and stepped right over it thinking it has to be more complex or that you already have it all figured out.

But what you find again and again, if you take the time to understand and master any skill is that simple is better. You also realize that what you thought was too simple to be the truth is actually all there is to it.

The truth is that which cannot be simpler.

The people who achieved great success in life mastered a few fundamental and universal truths better than anyone else.

So what does the market cycle look like?

Here you go.

I know. I know. You’ve seen it a million times. You got it.

But stick with me for a moment here. You’ve seen this a million times but have you ever really seen it?

Be honest. Probably not.

Now stop reading for a minute. Look at this graphic. Really look at it. Burn it into your brain. Then come back. The article can wait. Take as much time as you need.

Back?

Cool. Now your first thought is that this graphic only applies to bubbles and tulip crazed assets like gold and Bitcoin, right?

Wrong.

This cycle applies to all assets, at all times, in all markets. The cycle is eternal.

This is the universal market cycle.

No asset is exempt.

Every asset will follow this pattern at some point. The mountain might be spread out over many, many years, which is why most people miss it. They’re zoomed in too far.

Zoom out!

Look at the market over time and you’ll see this pattern again and again and again.

Now I know you’ve been taught that the market is random chaos. The efficient market hypothesis says that all market information is perfectly distributed and priced into an asset and eventually the market beats everyone. This is utter and complete nonsense. The only people who believe it are academics and people who have never risked a single cent in their whole life.

Information is absolutely not evenly distributed. It’s asymmetrical. And just because everyone gets the same information eventually doesn’t mean they know what to do with it. Most people simply can’t process that information correctly and make good decisions. They can’t separate the signal from the noise.

In other words, the average person hasn’t gotten a whole lot smarter.

That’s why I can give out this information to whoever wants to read it. I don’t need to keep strategies a secret because most folks won’t believe it or have any idea what to do with it.

Remember the legendary Turtle Traders experiment? That’s when some great market masters wondered if trading was nature or nurture. In other words could they teach people the rules and turn them into trading superstars who made millions?

Here are the complete rules they used, free of charge, written by one of the original turtles. (Quick note: I had the wrong link in there earlier. Fixed now.)

He gave them away.

Why?

Because most folks won’t use them, won’t know how to apply them or think the rules are too old and the markets have already moved past them.

And even if they understand these rules, they won’t follow them in times of great stress. The market loves to play with your emotions like a cat playing with a string. One of the greatest moments in turtle trader history is a guy who lost thirty two trades in a row on coffee and gave up, swearing the system would never work. He walked away and never returned.

The very next coffee trade skyrocketed.

The market is “global psychological warfare,” as legendary trader Jesse C. Stine writes in the single greatest book ever written on badass momentum trading, Insider Buy Superstocks: The Super Laws of How I Turned $46K into $6.8 Million (14,972%) in 28 Months. Stop reading and go buy it right away. It will change your trading game overnight. Get it and come on back. I’ll wait.

I know. I know. The title just screams scam. BS. Crap. Nonsense.

But it’s not. Despite it’s super click bait title, it’s filled with tremendous wisdom and practical steps from someone who actually did it. This is not a pretender. This is someone who delivered and decided to share his knowledge with the world.

That is incredibly rare.

Most people have a breakthrough realization and they just drop out of society after they get it. Once you figure out a great truth there’s nothing to do but execute on it. Why bother posting in any forum anymore? Why bother asking for anyone else’s advice? There is nothing more to learn from those places. So the master just fades away, trusting nothing but his own internal compass now.

And besides if you write down a great truth, it doesn’t matter because truth must be earned by each individual. It can’t be bought or cheated or even learned without personal dedication and hard work.

So why bother? Not only will most people ignore you, even worse some will turn actively hostile to you. They’ll hate you for your knowledge. The people suffering the worst, the ones who live their whole life in fear and who live with a constant undercurrent of self loathing will lash out at you, call you a liar and a fool and a scammer.

And that’s why most people don’t even bother to teach. They just master Kung Fu and disappear to the temple to practice in simple joy for the rest of their life.

But some people even go beyond that and become great teachers because there’s a special kind of joy in sharing knowledge that is unmatched by anything else in life and makes it all worth the suffering.

That’s why Stine shared his knowledge and I will too.

The Charts You’ve Been Waiting For

So let’s look at some real crypto charts to see the market cycle in action.

Here is Bitcoin after its huge parabolic run up the mountain starting in January of 2017 and taking off big time in the summer before starting to crash out in Dec.

Do you see the mountain?

Do you see us coming down the mountain?

Go ahead and zoom out on Bitcoin to the 2 hour or 4 hour chart and lay that market cycle graph right on top of it. What do you see? Ignore all my old lines. Those are for me and mean nothing to you. Just look at the Bitcoin price movement alone.

Looks the same right?

Of course, not every single asset follows that chart precisely. Don’t get fundamentalist on it. Bitcoin can come down and decide to boom up again half way through, but just be prepared if it doesn’t.

How do you know when a trend has changed? When the trend is changed.

Perhaps the greatest trader of all time, Ed Seykota, who you can read about in the great book, Market Wizards, is a man who’s returned 40% to 60% every year since the 1980’s with his own system. Yet when people go to hear him talk, they think he’s kind of an idiot. That’s because Buddha like gurus speak very directly and simply. Behind that simplicity is great power. It’s just people can’t hear it because they’re looking for something more complex.

Someone asked him “How do I know the trend is up?”

He said “When the trend is up.”

Most people hear that and think he’s trolling them or he’s a sarcastic jerk.

He’s not. He just gave you the real answer.

Did you miss it?

You only know the trend is up when it is consistently moving up.

Two points on a graph are not a trend. Three points are only the start of a trend.

The most basic truths in life sound absurd or ridiculous. But they’re still the truth.

People spend a lot of time trying to guess when the trend will change. They react to the first green candle in a downtrend or the first red candle in an up trend. They keep guessing. Ed does not guess. He follows the trend as far as it will go and then he waits for confirmation that the trend has changed.

Confirmation only comes over time. That means you won’t catch the exact bottom or sell at the exact top.

So how do you know when the exact top is in or the exact bottom?

You don’t. Not until it happens. And at that point you adjust.

It sounds simple but it’s ridiculously hard in practice because you’re trading against your emotions and your most basic instincts for self preservation which are screaming get out now! It will all come crashing down! The end is near!

Humans are fear driven animals. We constantly imagine terrible tragedies in order to try to react ahead of them. But the problem is that you spend your whole life reacting to imaginary events instead of the one real one. That is the path to suffering and pain.

Tragedies will come eventually. Deal with them then and not a second before that time.

Here’s a riddle. Is the bottom for Bitcoin $14,000? How about $11,000? How about $8,000? $4,000? $400?

Answer: Nobody knows.

Anyone who says they do is fooling themselves and you.

We can draw support lines and those are very useful. When a price bounces off that support we get a sense that the direction is changing or continuing. A good support trend indicator is the Exponential Moving Average 200, 50 and 10 or EMA 200, 50, 10 on the 2 hour chart in crypto. In more established markets, the EMA 10 on the weekly chart is about all you need.

But remember that just because something bounces off our predicted support does not mean the trend is really reversed. The price will often bounce and test that support again and again. The trend can go sideways until it decides to go down or up again.

See what the great game is giving you. Play the board.

The trend is down until it’s not. It’s going sideways until it’s not. It’s going up until it’s not.

Always bet with the trend. When your trades start to go sour, pause and stay out. Wait for the next trend to confirm and then go with that trend.

If the price action is bouncing around in a sideways channel then sell at the top of that channel after it starts to sink down after bouncing off the top line. If it hits the bottom, buy. Let it approach the top of the channel and see if it breaks out and bursts to the sky. If it does, hold. If not, sell it again and assume the sideways trend is going to continue.

Take a look at this graphic of the ultimate pattern to trade for assets.

Every time I show this graphic to people they start asking me about when the breakout from the bottom basing channel is going to come. I have no idea. Tomorrow. Next week. Next month. Next year.

But how do you know, they ask? You don’t.

You just buy when it actually breaks out.

Now from there the price can do several things. It can crash back down into the channel. That’s where you sell with your stop loss. It’s a failed break out. Or it can keep going, so you stay with it. At some point it will start to pull back, but be sure to zoom out and see if it’s still moving in its uptrend, even if it’s pulling back. Stop looking at five minute charts and thirty minutes charts. Waste of time.

Now let’s take a look at Zcash.

Notice how it’s been through a massive run up only to crash down and then finally stabilize with a long base.

Right now, its linear regression channel, which you can see in red and blue, is pointing up. You can find the linear regression indicator on Trading View. It automatically draws based on the scatter plot of closing candle prices. Linear regression finds the best line through a trend, whether that is up, down or sideways.

At some point the coin will start to rally out of its strong base and start another journey up the mountain.

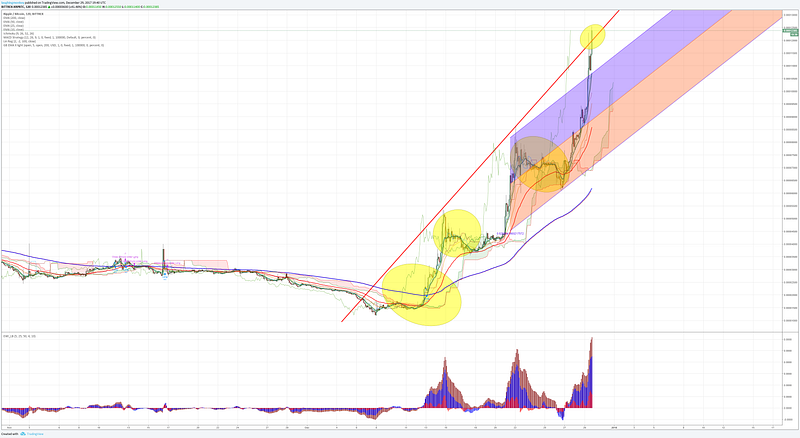

Now let’s take a look at Ripple starting in on its big run.

It’s previous mountain move is off the chart, but it did the same thing as the other two. Just zoom out if you want to see it. It went way up, then crashed down and then slowly slid and formed a strong base before breaking out on high volume above its 200 bar exponential moving average on the 2 hour charts.

I’ve discovered that cryptos move a lot faster than more liquid and efficient markets like the Nasdaq or New York Stock Exchange. Whereas a daily or weekly chart will serve you much better trading those markets, the short time frame of two to four hours works better for catching the runs in crypto.

Don’t take that as gospel though. Go ahead and see for yourself. If you find a better time line, go with that one. A good time line has fewer moves through it not more. Fewer. Less trades are better. Stop over trading.

Notice that XRP has gone up three legs here on its parabolic run. I bought after the second run up and pullback because it was a double confirmed up trend on high volume. It burst out above its EMA 200 and ran. Then it pulled back, staying above that line before taking off again. I first noticed it breaking out of its base at a high “angle of attack” as Stine calls it. That is my red line that goes up at a 45 degree angle along the top of the trend.

Usually there are five waves to these runs. While other traders were calling the rally over, I decided to buy because I could see the parabolic run pattern forming and only two steps in its clearly defined ladder.

Other traders were calling the top because they’re trading their belief systems and psychology and refusing to see the chart as it was actually playing out. That’s because most folks in crypto don’t like the centralized nature of Ripple.

I don’t either. I hope Ripple fails long term in favor of a more decentralized asset. That said, when it comes to trading, I don’t have the luxury of wasting time with my moral belief system.

I will happily take money from Ripple and then move it into assets I care about long term. Ripple will fail or succeed no matter what I do. The market will ultimately decide if it’s worth keeping around.

But if you let your beliefs blind you to what is right in front of you, you will fail.

The market doesn’t care about your opinions or what you like and don’t like. It does what it wants, when it wants, and this chart was signalling one thing: XRP was ready to really break out. So while others were shorting I went long and captured the third wave in its big new run.

I then sold for profits as it started to pull back and shorted it to max profits. When it stabilized I bought back in for the next wave.

The Truth

Understanding the truth will set you free.

Your beliefs are a prison system you’ve created for yourself.

But here’s the thing. The door is not locked. It never was and you can escape your limiting ideas about reality any time you want to open that door.

So do it. Open that door.

Observe. Don’t imagine. See the chart as it actually is and then you can begin to make good decisions.

Use trial and error to test your observations. If your observations are wrong, discard them ruthlessly and move on to the next observation.

The market cycle is universal. Capturing the parabolic run is the holy grail of trading in any market. It’s where the big money is and where people get rich playing the market.

Go ahead and look at almost any chart and you will find this pattern on a long enough time line. When it comes to new stocks, aka new companies, or new cryptos there isn’t enough time for it to form correctly. So basically you will just see a flat trading baseline.

From there you can only go and look at the project fundamentals. Read the white paper. Follow the team. Get on their Slack channels. Get a sense of whether they will succeed or fail over time. Then you can decide if you want to take a chance and invest in them for an eventual run at glory.

But go look at any asset or coin that’s been around a bit and you’ll see The Pattern. Doesn’t matter if it’s Zcash or Amazon or Facebook or Netflix or gold or oil or sugar.

Don’t get caught up in looking for the pattern to manifest perfectly every time. This is not some rigid pattern that always happens precisely. Sometimes a stock or coin gets really choppy, thrashing up and down or moves like a wild snake but eventually, slowly but surely it will form the mountain run and collapse.

The key is to know how to buy at the bottom and get out at the top.

That’s the part buy and holders always miss. They get to laugh at traders on the way up because the trader didn’t get to catch the entire movement. They got out a little early and miss the crazy explosion at the very end but traders get the last laugh as the market or asset starts to slide because they sell and the holders keep holding as 40% or 85% of their gains vaporize.

Master the art of selling!

If you don’t know when to sell what you’re buying and holding what’s the point?

Once you understand this and recognize it as true, only then can you start to dominate the market consistently.

And then maybe, just maybe, you might be able to quit your job, move to paradise and do whatever you want for the rest of your life.

Happy trading.

############################################

DISCLAIMER: Be a big boy or girl and make your own decisions about where to put your hard earned money. I am not a financial adviser and this is not financial advice and if I really need to tell you this then it’s best to keep your money under a mattress anyway because when you lose it you’ll only blame other people for your mistakes rather than yourself.

############################################

If you love my work please visit my Patreon page because that’s where I share special insights with all my fans. Top Patrons get EXCLUSIVE ACCESS to the legendary Coin Sheets Discord where you’ll find:

Market calls from me and other pro technical analysis masters.

Access to the Coin’bassaders only private chat.

Behind the scenes look at how I and other pros interpret the market.

You also get exclusive access to a monthly virtual meet up with me, where I’ll share everything I’m working on and give you a behind the scenes look at my process.

I’ll follow each talk with a Q&A session. Ask me anything and I just might answer.

############################################

If you love the crypto space as much as I do, come on over and join DecStack, the Virtual Co-Working Spot for CryptoCurrency and Decentralized App Projects, where you can rub elbows with multiple projects. It’s totally free forever. Just come on in and socialize, work together, share code and ideas. Make your ideas better through feedback. Find new friends. Meet your new family.

############################################

For some of my most exclusive stories and the best utility coin research on the planet, check out Strategic Coin!

############################################

A bit about me: I’m an author, engineer and serial entrepreneur. During the last two decades, I’ve covered a broad range of tech from Linux to virtualization and containers.

Readers have called my breakout nanopunk novel, The Scorpion Game, “the first serious competition to Neuromancer” and “Detective noir meets Johnny Mnemonic.”

You can also check out the Cicada open source project based on ideas from the book that outlines how to make that tech a reality right now and you can get in on the alpha.

############################################

Lastly, you can join my private Facebook group, the Nanopunk Posthuman Assassins, where we discuss all things tech, sci-fi, fantasy and more.

############################################

Is there a reason you don’t have a Money Badger t-shirt? You might want one because they’re a hell of a lot cheaper than Bitcoin.