“Do you Mex?”

I heard those words whispered to me on an elite crypto trader forum one fine evening as the sun sank in the late summer twilight.

It sounded like the chant of the drug dealers who used to chase me through Washington Square park when I was a kid at NYU.

“Smoke? Smoke? Hey. You smoke? You Mex?”

I stared at the screen. Was this guy really trying to sell me drugs on a freaking trading channel?

“What the hell are you talking about?” I said.

“Mex. Do you Bitmex?”

“What’s that?”

“It’s an exchange.”

“Okay. So what? What’s so good about it?”

“It offers up to 100x leverage.”

“Um, that’s fucking insane.”

“Yeah. It kind of is but it’s kind of addicting too.”

And that was the last I thought about it for a bit.

But it kept coming up again and again. All the elite traders I knew loved it. Some traded on it exclusively. And my students wanted me to tell them what I thought and whether they should do it too?

I couldn’t understand it. Why would anyone use 100x leverage?

It’s hard enough to manage your risk when you’re just buying and selling in the wild west of crypto. Lots of leverage only magnifies that risk to terrifying new levels.

When I saw traders talking about getting liquidated as if it were some kind of badge of honor it only made me more leery.

Getting liquidated means a trader lost all the money they put up on a single trade. Let’s say you risked 10 Bitcoin at 10X leverage. Bitmex gives you a liquidation price when you place a trade. It the trade goes south on you it can really go south. If you hit the liquidation price, you just vaporized those 10 Bitcoin.

In case you’re not paying attention that’s a 100% loss.

That didn’t seem like trading to me. It seemed like gambling.

And despite my theory that all trading is gambling, there’s good games at the casinos, like poker, where you’re even with the house and bad games at the casino, like slots, where you might as well just set your money on fire to save yourself time.

Mex felt like slots.

Still, I got more and more requests to dig into Bitmex and give my thoughts on the wildest exchange in the wild west. I started asking around to see if it lived up to the hype.

What I found fascinated me endlessly.

So come with me and I’ll take you down the rabbit hole of off shore tax havens and mega crypto whales making waves far out at sea that smash the lowliest traders.

And we’ll dive into the strategies you need to survive on the most advanced and powerful crypto exchange in the world.

A Tiny Island in the Indian Ocean

But before we get too deep we have to start with some bad news.

Unfortunately, Bitmex is not available to US traders.

And yes I know people use several methods to do it anyway, but I’m not here to teach people how to break the law. If you want to do that, that’s on you. Hit Reddit or 4Chan but don’t bother asking me because you’ll only get the cold shoulder.

Bitmex is not open to US traders because the exchange is based out of the Seychelles, a tiny little island nation in the bright blue of the Indian Ocean, that doesn’t bother with the kind of strict laws that the rest of the financial world have come to love and loathe. There’s no minimum capital requirements, no audits and companies there pay zero income tax.

Oh and they don’t do KYC, aka Know Your Customer, the insidious and annoying laws that hit the books everywhere as anti-terrorism fever ripped through the rich world’s law-making bodies.

If the Seychelles sounds like the kind of place where the super rich hide their money, that’s because that’s exactly what it is, a tax haven of the highest order.

Of course, despite the sensationalism of the Panama Papers and big leaks that exposed the complex web of financial instruments that the rich and famous use to shelter their money, not every company or person who puts their money there is some kind of criminal. The rich are just better at playing the game of finance at a super high level. The fact is almost every person or company in the world would love to take advantage of the kinds of tax breaks and legal loopholes that the richest of the rich use every day.

Don’t get me wrong. I’m not saying there aren’t evil and hideous people hiding money in the world’s tax havens. Of course there are. That’s a known fact that nobody can deny. What I’m saying is that not every company that runs out of a tax haven is Evil Corp.

Remember that life is shades of gray, not black and white. Black and white thinking is insanity. Nothing is all good or all bad.

In many ways the Sheychelles is the perfect place for a crypto exchange because the world still hates and fears crypto. And what people fear, they attack. Until the world’s regulations catch up with the brand new asset class that crypto represents, it’s inevitable that some of the biggest crypto companies will seek shelter in warm places with friendly laws that welcome them with open arms.

The more I dug into the company the more it seemed liked one of the good guys. It was started by a refugee from the banking industry, Arthur Hayes. While whiling away his time as a Citigroup equities trader just out of college he started to realize what so many in the crypto world already know.

The heyday of making big money in the regular markets is over.

Every trader knows that volatile markets make you the real money. Where there’s risk, there’s reward.

It’s only regulators and mom and pop traders that want to stamp out every ounce of chaos. They don’t realize that by doing it they just stripped all the profit out too.

Well, almost all of it.

The big bank middlemen who hold all the cards still make a lot of money on fees and they manage to do it with pretty much zero skin in the game. When their trades go bust, they get a bailout and walk away from it Scott free while you just eat your losses in bitterness.

Instead of the wild commodities and FOREX markets of the 70’s and 80’s, where legendary traders made and lost mega-fortunes, Hayes, you and me graduated into a world of circuit breakers, endless stacks of life sucking regulation and super “efficient” markets, aka slow and anemic markets that only give people the illusion they’re making money.

In other words, boring.

“We missed out on the peak of finance,” says Hayes in this brilliant article in Bloomberg. “Instead we got the decline. There’s not as much money, not as much risk, not as much flow. It’s boring. Bitcoin reminds us of what it must have been like trading an asset class in the late ’80s and ’90s.”

Hayes wanted to create a crypto trader paradise, one that hearkened back to the grand old glory days of finance where you could lose everything or win big.

That’s exactly what he did. Bitmex is one of the most incredible and advanced exchanges anywhere in the world, for any kind of trading.

And the more I learned about it, the more I realized how badly Americans screwed up their regulations out of fear and stupidity, and how far behind we’re getting with financial innovation and every other kind of innovation too from AI, to biotech, to renewable energy.

If we’re not careful we’ll find the empire didn’t fall because of China or globalization but because we got so worried about trying to catch a few bad guys that we strangled innovation with absurd and overreaching laws, like FACTA, which demand extensive financial information on even foreign companies that serve any U.S. customers. FACTA came about in the frenzy of fear and paranoia after 9/11, as American law makers dramatically expanded the reach of big brother and the surveillance state in ways we’re only beginning to understand now.

Don’t worry though, just because I can’t trade there, I know how to do research like nobody else. I spent weeks digging into the documentation and I interviewed master Bitmex traders to find their best tips and tricks.

Ready to find out what I learned?

Let’s rock.

Number One: Options and Futures, Oh My

The first thing you want to know about Bitmex is you’re trading options not actual Bitcoins or alt coins. It’s the first major derivatives market for cryptocurrency.

That means you can sell and more importantly sell short. Selling short let’s you profit when Bitcoin drops like a rock.

With the crypto market still at the banana republic stage of development it’s no secret that it’s super volatile. Bitcoin, the grand daddy of crypto, hit $20,000 last year only to plunge down to $5000+ this year.

If you could profit from the wild ride up and down, why wouldn’t you?

Even more important, Bitmex lets you short Bitcoin with Bitcoin. That’s right.

Bitmex doesn’t take fiat but it let’s you go long or short on Bitcoin through a clever hack. It sets each of its contracts at $1 USD. So if Bitcoin is trading at $10,000 and you buy $10,000 worth of contracts you bought the equivalent of a single Bitcoin. If you bought $5,000 of contracts you bought the equivalent of half a Bitcoin.

Mex has two major types of options contracts: Futures contracts and the infinitely more popular Perpetual Contract.

What’s the difference?

If you’ve ever traded futures like sugar or oil on a traditional commodities exchange like the CME or CBOE, you’re essentially betting on a future price. Futures contracts have an expiration date. That means at some point the contract is automatically settled. Win or lose, when the close date comes calling you’re finished and the contract is settled and cashed out.

Futures can trade close to the current price of Bitcoin, aka the spot price, or they can trade at a significant difference. A futures contract for Dec 2018 might get priced at $15,000 when the current price is hovering at $7,000.

With all that said, most of the traders I talked to didn’t bother playing with the more traditional Futures Contracts. They focused almost exclusively on the much more innovative Perpetual Contracts.

The Perpetual Contracts never expire. They trade constantly and they come very close to the current spot price. That means you’re never getting tapped out just because you bungled the date. You might correctly predict Bitcoin is going back to $15,000 but since nobody has a crystal ball it could hit that in Dec 2018 or Dec 2019 or Dec 2025. You just don’t know. A perpetual contract let’s you hold onto your options forever if you want to hold onto them.

Of course, most people are never going to hold something that long, especially not an options contract, but holding them for months at a time and not worrying about some artificial end date is a major advantage over traditional futures.

The Perpetual Contracts do hit you for little wins and losses several times a day, every eight hours to be specific. The exchange figures that out through a process called funding. The funding rate gets calculated by combining interest and the premium/discount rate.

What’s all that you’re wondering?

When you sell short or margin trade you’re borrowing some big fish’s coins. You’re paying interest to those big fish for borrowing their coins just like you would to a bank or a loan shark.

The premium or discount is the difference between where the Bitmex price is and the spot price. On the charts you can see it as a purple line with the label Bitmex price.

When you buy or sell you’re buying the Bitmex price not the spot price. The difference between the two is crucial and we’ll dive into how you can profit or lose from that difference a little later. For now all you need to know is that when eight hours are up you take a little loss or a win based on the difference between the prices if you’re still holding a perpetual contract.

“When the Funding Rate is positive, longs pay shorts. When it is negative, shorts pay longs.”

In other words, depending on what side of the trade you are, you either get dinged or you get a little extra Bitcoin in your bucket.

So now you’re ready to get trading, right?

Hold on there, cowboy or cowgirl. That’s a lot to take in.

If you start digging into the any of the Bitmex support documents I linked to your head is probably spinning. They’re full of equations and short on good explanations.

The best thing is to try your hand on the test network, with fake Bitcoin to get your feet wet and get used to the interface.

You’re swimming with the whales now so take your time and get your head right before diving into the deep end.

Now, let’s get into some tips and tricks that master traders shared with me to make your journey into the wonderful world of Bitmex beautiful and more importantly, profitable.

Number Two: Don’t Get Liquidated

There’s another aspect of Bitmex that you need to understand right now before you go any further, the liquidation price.

What’s liquidation?

Liquidation is the price where you lose 100% of what you risked on a single trade.

If that strikes fear into your heart that’s good. You never want to lose 100% on a single trade if you can possibly avoid it.

But it’s not all bad. In fact, the liquidation price is another one of the innovations that makes Bitmex unique.

You see, Bitmex has major advantages over traditional margin accounts.

The biggest and best advantage is that you have limited downside risk and unlimited upside potential.

What does that mean?

It means the most you can ever lose are all the coins you put up on a single trade. If you put up one Bitcoin, you can only lose one Bitcoin.

That’s amazing and unlike any other exchange that I’m aware of in the crypto or traditional world. Here’s why:

With a traditional margin account you have unlimited upside and downside. That’s because you’re borrowing someone else’s money. With traditional margin you need a buffer of cash in your account, usually double or quadruple what you’re trading to cover the dreaded margin call.

What’s a margin call?

Let’s say you put up one million dollars on oil at 5X leverage, in essence betting 5 million dollars.

You wake up and oil opens down 50%. It blew through your stop. You’ve lost 2.5 million dollars. That means you lost your original million dollars and you now owe 1.5 million on top of it.

Your creditors cut you off and tell you they want their money right now.

That’s a margin call.

Here’s the good news. That simply can’t happen in Bitmex.

There’s no way for the exchange to come and get more Bitcoin from you if a trade goes against you so they came up with a brilliant alternative, the liquidation price. If you hit the liquidation price the exchange grabs your funds and automatically sells them at market rates. It’s how they avoid having people hold two times or threes times the number of Bitcoins in their account to do margin trading.

It’s an innovation I expect to see traditional markets pirate in the not too distant future.

Now the question in your mind is, why would I ever want to get liquidated? Good question.

While it’s oddly comforting and hilarious to watch vast fortunes get vaporized on the Bitmex Rekt feed on Twitter, the answer is you don’t want to get liquidated.

Again and again big traders emphasized to me:

Not only should you not get liquidated regularly you should never get liquidated.

I’ve seen some traders in forums bragging about getting liquidated like it’s a badge of honor. It’s not a badge of honor, it’s just bad trading.

There’s two ways to make sure you never get liquidated:

Use stops

Don’t use too much leverage

First, stops should always sit well above the liquidation price. If your stop is too close to the liquidation price you’re doing it wrong. The slightest screw up could send the price crashing through your stop and blast your Bitcoin into oblivion.

Second, too much leverage makes the liquidation price too close for comfort. The higher you go, the worse it gets.

Leverage is a second category all to itself so let’s give it its own big and beautiful marquee and dive in further.

Number Three: The Joy and Pain of Leverage

If you’re not an experienced trader, who’s known great suffering and great triumph and lived to tell the tale, you shouldn’t go anywhere near leverage. Just say no. Come back when you know what you’re doing.

Using leverage when you’re not ready is like getting blackjacked in an alley, waking up in a cold ice bath and finding someone sliced out your organs with a dirty knife and left you to bleed out.

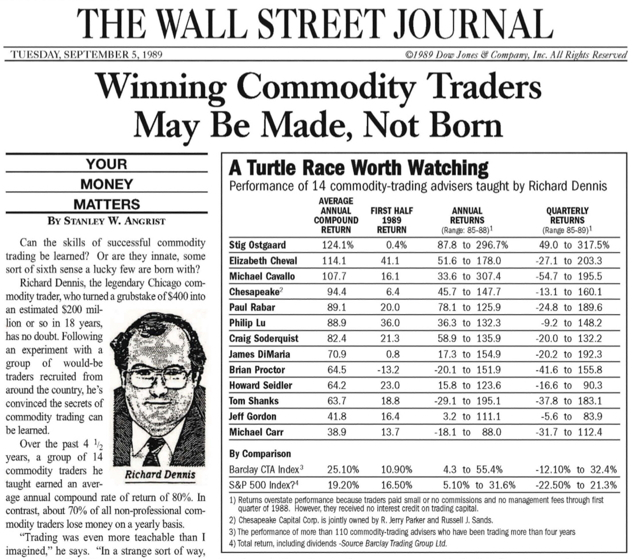

Of course, the legendary traders of the 80’s that Hayes idolized all used leverage. I’ve written extensively about the Turtles in past articles and they lived and died on it.

Leverage can be your friend or your worst enemy.

There’s smart leverage and ridiculously stupid leverage.

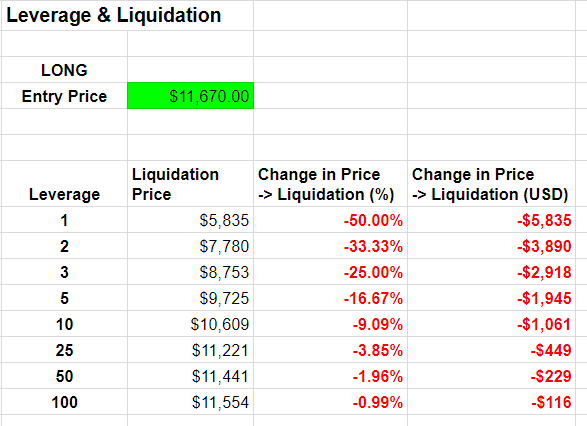

Here’s a handy dandy chart from this excellent article on Hacker Noon called the Quick Start Guide to Leverage Trading on Bitmex.

Note that as soon as you start getting to 10X and above the price barely needs to move before you get vaporized.

9% is nothing to Bitcoin. It’s regularly moves that in a single day. At 25X and higher you are playing with fire. 3%? That’s suicide.

Statistics and probability are so far out of your favor that you might as well get out a magnifying glass, take your money out back and burn it up like you used to burn army men back in the day.

Oh and that 100X leverage trade? Pure idiocy.

Don’t fucking do it. Period.

A half percent move can happen in seconds. You have to get absurdly lucky to win this trade. We’re talking lotto bazillionaire lucky. That’s not even close to sound trading, it’s straight-up, slot machine gambling.

Sadly, I’ve watched a number of traders I once loved get destroyed gambling their fortunes away. They did it by not setting stops and using absurdly high leverage. Sorry, but this is ridiculous.

Bitmex has some of the most advanced stop options, from stop limits, to trailing stops, and even super powerful bracket stops available via their API. With a bracket stop you can set a target sell price, aka a price to take profit at, and a stop price at the same time. Whichever hits first cancels the other order. That’s amazing.

Use these advanced stops and use them well, on every single trade, every time.

Most exchanges don’t even come close to offering this kind of advanced stopping power. You’ve got to build your own bot with its own logic.

These are dream settings that every exchange should use right now. For the life of me I can’t figure out why the other players don’t have these kinds of super sophisticated stops other then they’re lazy or just overwhelmed keeping up with US regulation so they have to hire ten lawyers instead of ten programmers.

But back to the lecture at hand: If you’re getting liquidated it’s because you’re not practicing good money management. Simple as that.

Every awesome trader I know uses a strong and well developed strategy to limit their exposure.

You should too.

Risk management is a thousand times more important than your trading strategy.

Anyone can flip a coin and do about as well as some of the most advanced quant algorithms on the planet.

A million monkeys throwing darts at a newspaper can beat the best of the best, but those damn monkeys will never beat a trader practicing good money management.

So be a good trader and not a monkey. Don’t get liquidated.

Number Four: Bitmex Risk Management like a Badass

How do you practice good money management?

In my article Crypto Trading Bible Three: Winning in Sideways and Bear Markets, I break down sound risk management strategies that every good trader I know follows religiously.

Here’s the deal though, those strategies suffer when you start using a lot of leverage. You need to have an abacus in your head because you can quickly lose a lot more with the primary strategy I laid out there.

What is that strategy?

It’s a modified 1% risk per trade strategy.

I figured out that if you’re only putting up 1% of your money on a single trade, like so many traders recommend you do, you’re leaving a lot of money on the table. That means 99% of your cash is sitting on the sidelines doing nothing.

To fix that I came up with a different method. I calculate 1% of my total portfolio and then use the difference between where I will set my stop and where the price is to figure out how much I can put up on a single trade. It lets me risk a lot more money while still limiting my downside almost perfectly.

Here’s a quick refresher on how it works, from my last article:

First, we calculate the delta between the current price and the current stop. We’ll use round numbers in our examples to keep it easy to understand.

Let’s say Bitcoin is at $8,000. Your stop loss calculation puts the current stop at $7,700, a $300 difference on a single Bitcoin.

Now that we have that delta we can use that to figure out how to risk only 1% of our total trading stack on a single trade. Let’s pretend you have $100,000 in total cash to risk.

$100,000 X .01 = $1,000.

At most we want to risk only $1,000 on this trade. So let’s divide the delta of the current price and our stop loss by 1000.

1000 / 300 = 3.33

That means we can buy up to 3.33 Bitcoins, if we set the stop loss to $7,700, because on each Bitcoin we only stand to lose $300 if the trade goes against us. With 3.33 Bitcoins the total loss on all of them would equal $1,000 or 1% of our portfolio.

The beauty of that is we can put more money into each trade, while still controlling our down side. In this case we put $26,666 dollars of our $100,000 into this single trade, which gives us the potential to realize more compounding gains should the trade go in our favor.

Unfortunately, leverage screws this whole formula up very badly.

Even 2X leverage doubles your risk and blows it all to hell. You can modify the formula to fix that but you’ll be hitting Excel every time you place a trade. I won’t do the math for you here but you can figure it out. Just note that every time you add another layer of leverage you add more risk, which means your stop has to get closer or you need to risk a lot less of your total portfolio to do the same hack I did above.

There’s a reason I am not sharing the modified formula with you. It’s not because it’s some kind of wizard magic that only I know.

It’s because it’s worth the effort for you to go through the exercise of figuring it out yourself. Sit down and force yourself to do the math.

We learn by doing and if I do it for you, you won’t learn a damn thing.

But let’s say you want to get started right away without having to crank through a difficult formula. Here’s how you can do it:

Go back to risking only 1% on a single trade. That means if you have $100,000 you’re only putting up $1,000 on a trade. No matter what you can’t lose more than that, even if you get liquidated.

After you’ve done that for awhile and gotten used to trading with different levels of leverage that you can start to dig into more advanced portfolio calculations.

Number Five: Know Your Mex Price

Every trader I talked to told me about the little purple line on your chart that you’ll want to get to know very, very well. That’s the Bitmex price or “fair market price.” Frankly, the explanation on their site is utterly terrible.

There are a few articles that try to explain how the Fair Market Price gets calculated but they’ll probably just confuse you more.

Here’s all you need to really know. The Bitmex price is rarely in line with the spot price. Usually it’s trading above or below the spot price.

If it’s above the price, it’s trading at a “premium.” If it’s below, it’s trading at a “discount.”

The Mex price can work for you or against you.

Let’s say the BTC spot price is $7000. Mex pulls their pricing data from equal parts Bitstamp and GDAX, though they’ve pulled from Poloniex in the past. They stopped doing Poloniex because smart whale traders could crash the price on Polo and smash a bunch of longs on Bitmex, only to scoop all those little fish up at bargain basement prices. Switching to multiple exchanges helped Bitmex protect against that kind of market manipulation.

Now let’s pretend the Mex price is trading 3% higher than the spot price, putting the price of BTC at around $7212. That means it’s trading at a premium if you want to go long.

Let’s say you’re doing a quick scalp trade to try to make 5% on a big expected move up . You’ve watched BTC all day and you’re sure it’s going higher. But the Mex price hasn’t caught up with your insight. Because of that you bought your BTC 3% higher than the spot price.

Guess what? That means that in order to make your 5% you now have to make 7% because you have to blast through that 3% premium just to make up for the difference and break even.

Very few of the amateur traders I talk to take this into account.

On the flip side the Mex can work in your favor too.

Let’s take the same scenario as we saw above. The spot price is $7000 and the Mex price is $7212. You think the bulls are wrong and you short Bitcoin. Now you’re getting them at a discount and you’re already in profit as soon as you hit the buy button. As soon as the price starts dropping it’s clear sailing and all you need to get 5% is a 5% move, not 7%.

In other words, it helps to be a smart contrarian on Bitmex and in life.

No matter what, you want to keep an eye on the difference between the prices because it factors big time into how much money you make. Sometimes, with alt coins, the Mex price is so out of whack with the spot price that you can’t hope to make a profit on a single trade so it’s not even worth entering even if you’ve got a strong signal to go long or short.

That’s All Folks

Bitmex is not for the faint of heart.

It’s the the battle ground of samurai and ninja and only the strongest still stand after the swords stop swinging and the blood and dust settle.

If you’re not an experienced trader you will get hurt on this wild and wonderful exchange. I’ve watched it happen again and again to inexperienced traders, as well as good ones that I know and love.

But it is possible to win on Bitmex, if you’re careful, methodical and smart.

You need to get the math of leverage and liquidation down cold. You need a perfect risk management strategy.

In short, you need to know what you’re doing.

But really, what doesn’t that apply to in life? You have to master your craft, no matter what you set your mind to, so get to doing it and you too can grapple with ninja until you become one yourself.

It’s a shame that so much innovation has to happen offshore because of horribly ineffective and overreaching laws and the fear the losing control of the money supply that cryptocurrency creates in panicked nation states. After digging deep into this innovative exchange, I have zero doubt that the major world exchanges are watching and learning secretly. It won’t be long before they look to adopt some of these amazing advances.

Of course, they’ll end up ruining a lot of the fun. They’ll make it so small traders never get a chance to become big traders by risking their own money. They’ll eventually force the “pattern day trader” rules down everyone’s throats, use circuit breakers and capital limitations and KYC. In short, they’ll make it slow and crippled and a shadow of what makes Bitmex and Bitcoin incredible.

But they will copy it, that’s for sure, and they should because there’s something incredible going on over there on that tiny island in the Indian Ocean.

It may be the most innovative exchange on the planet.

Today’s exchanges have engineered all the risk out of the markets and they’ve taken all the profit with it.

Even worse it’s actually an illusion.

The risk is still there, but the profits are slow and sluggish. You can put your money in a fund that nets you a slow and steady 3% to 5% a year, just barely beating inflation. But when the big crises happens and the markets crater overnight like they did in 2008’s Big Short, then all those slow and steady profits disappear like dust in the wind.

If you didn’t grow up slinging futures on the exchanges in the 80s, you’ve got another chance to live the dream of big risk and big reward.

Hayes set out to recapture the glory days of trading when he quit his lucrative and safe job as a traditional equities trader.

And by all accounts it looks like he’s done it.

Happy trading.

###########################################

DISCLAIMER: Be a big boy or girl and make your own decisions about where to put your hard earned money. I am not a financial adviser and this is not financial advice and if I really need to tell you this then it’s best to keep your money under a mattress anyway because when you lose it you’ll only blame other people for your mistakes rather than yourself.

###########################################

If you love my work please visit my Patreon page because that’s where I share special insights with all my fans.

Top Patrons get EXCLUSIVE ACCESS to so many things:

Early links to every article, podcast and private talk. You read it and hear first before anyone else!

A monthly virtual meet up and Q&A with me. Ask me anything and I’ll answer. I also share everything I’m working on and give you a behind the scenes look at my process.

Access to the legendary Coin Sheets Discord where you’ll find:

Market calls from me and other pro technical analysis masters.

The Coin’bassaders only private chat.

The private Turtle Beach channel, where coders share various versions of the Crypto Turtle Trader strategy and other signals and trading software.

Behind the scenes look at how I and other pros interpret the market.

############################################

I’ve got a new podcast, The Daily PostHuman, covering crypto, AI, tech, the future, history, society and more! Check it out for expanded coverage of my most famous articles and ideas. Get on the RSS feed and never miss an episode and stay tuned for some very special guests in the next few months!

############################################

A bit about me: I’m an author, engineer and serial entrepreneur. During the last two decades, I’ve covered a broad range of tech from Linux to virtualization and containers.

You can check out my latest novel, an epic Chinese sci-fi civil war saga where China throws off the chains of communism and becomes the world’s first direct democracy, running a highly advanced, artificially intelligent decentralized app platform with no leaders.

You can get a FREE copy of my first novel, The Scorpion Game, when you join my Readers Group. Readers have called it “the first serious competition to Neuromancer” and “Detective noir meets Johnny Mnemonic.”

############################################

Lastly, you can join my private Facebook group, the Nanopunk Posthuman Assassins, where we discuss all things tech, sci-fi, fantasy and more.

############################################